The USD Rally Proves Sticky

From the Desk of Ian Culley @IanCulley

All signs point to a weaker dollar.

Crude oil slipping below 78… interest rates cutting through a multi-month trendline… emerging market currencies hitting fresh year-to-date highs… risk assets ripping…

Yet the buck refuses to budge.

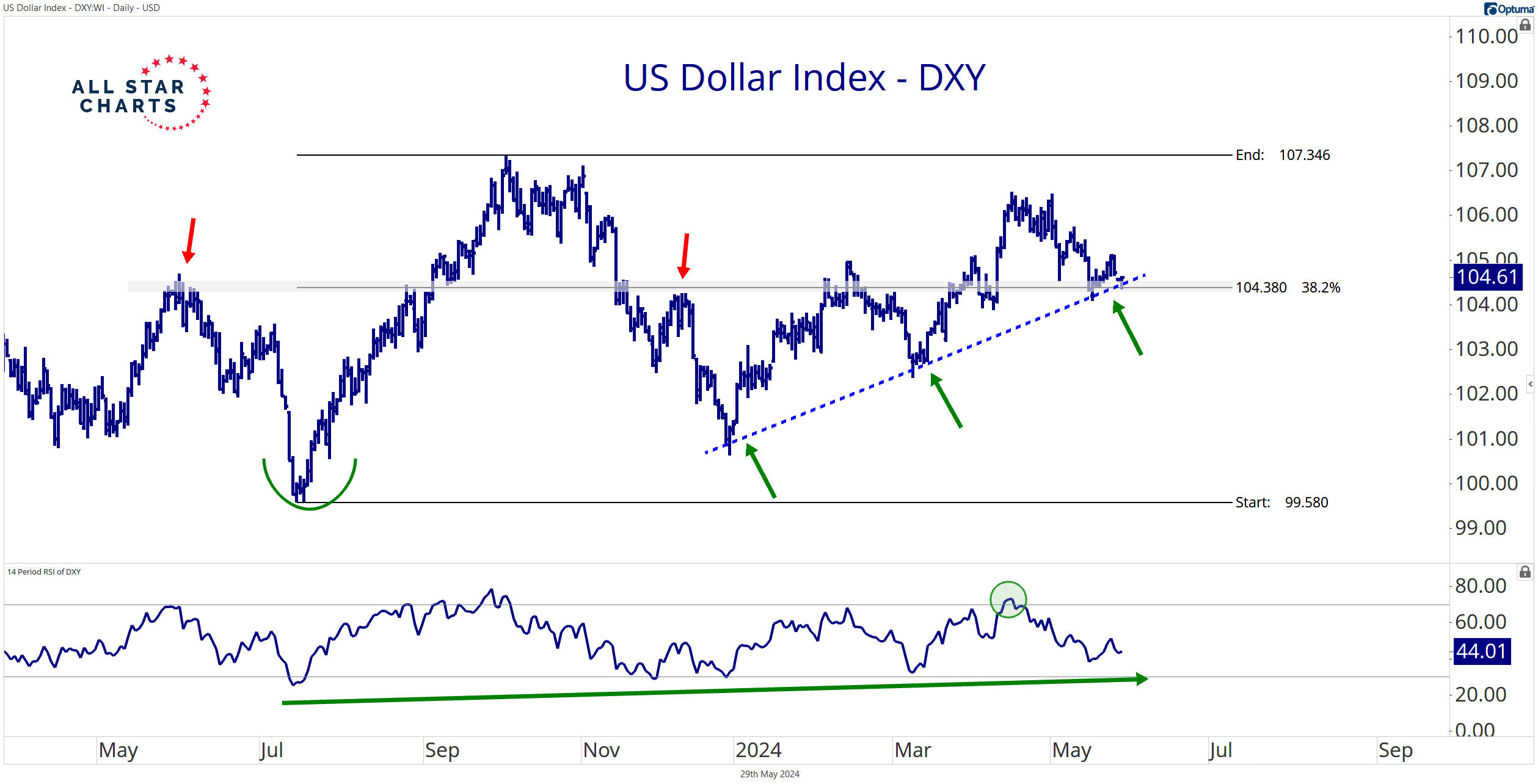

The US Dollar Index $DXY is holding steady at a confluence of support, marked by a critical polarity zone and the year-to-date trendline:

As long as DXY remains above the former resistance level of roughly 104.25, a bearish bias is challenging to maintain.

On the flip side, a decisive close below the April pivot low of 103.88 signals a shift toward dollar weakness.

Meanwhile, the mounting evidence sideling the buck has dissipated. Crude oil is trading above 80. Interest rates are snapping back. And the risk-on rally is taking a breather.

Maybe the dollar was right the entire time.

Or, perhaps the current bout of USD strength will vanish with the next round of soft economic data.

Either way, markets will likely remain choppy heading into the November election.

Of course, stocks can still reach new highs, and the dollar can break down to fresh lows. But you and I are better off focusing on our levels and trading what’s in front of us.

What are your thoughts on the dollar?

-Ian

Thanks for reading.

Be sure to download this week’s Currency Report!

Premium Members can log in to access our Weekly Currency Report. Please log in or start your risk-free 30-day trial today.

The post The USD Rally Proves Sticky appeared first on All Star Charts.