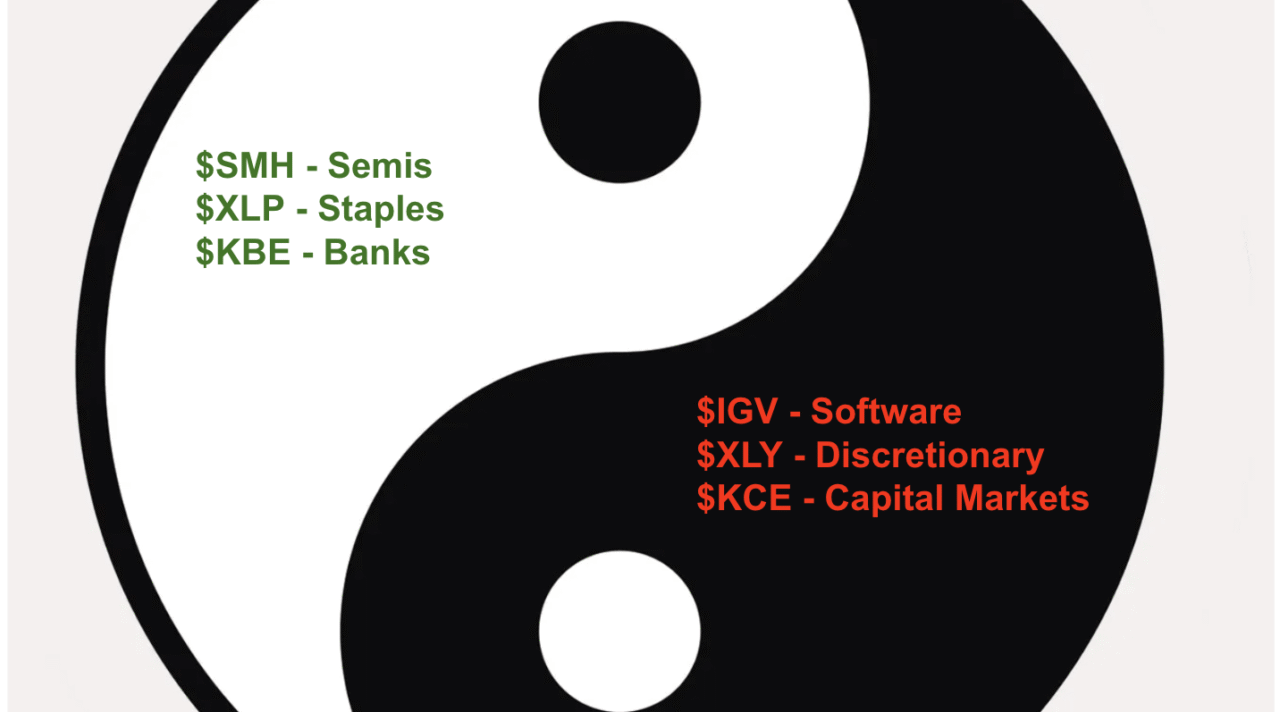

The Yin and Yang of This Market

Leadership vs. Breadth

The cleanest way to frame this market is breadth versus leadership.

The “Balance” of This Market

Yin is breadth.

The supportive part of the market that’s quietly doing its job.

Yang is leadership.

The visible heavyweights, the starters, the stocks that actually move the scoreboard.

Right now, Yin is keeping us from breaking down.

Yang is keeping us from breaking out.

That’s why the index feels like dead money.

The Yin: Quiet Strength Beneath the Surface

If you peel back the curtain, the market of stocks looks a lot healthier than the headline suggests.

Equal weight is acting fine. The Russell 1000 Equal Weight, roughly 90 percent of U.S. market cap, is sitting near all-time highs.

Breadth is Healthy

You can see the Yin showing up in pockets that are doing exactly what they are supposed to do in a messy tape.

Semiconductors have been the Yin within technology.

The Yin of Technology

SMH has held trend structure and reclaimed key levels, it has been the stabilizer inside a sector that everyone keeps judging by software.

Then you have little guys of the Yin.

Staples, Energy, Materials, Industrials all acting strong.

Not exciting for the narrative merchants, but helpful for the tape.

This is what’s keeping the market from breaking down.

The Yang: Leadership Fatigue Is the Cap

Now the other side.

Yang is the part everyone sees. The heavyweights. The starters. The ones that carry the index when the market is in gear.

And right now, they are not in gear.

Software has been the Yang inside tech.

IGV is losing momentum and pressing into major levels.

Consumer Discretionary has been the Yang in the consumer complex.

XLY has struggled, it has registered a failed breakout, and it is fighting around the 200-day area.

And then there’s the big one.

The MAG 7.

Roughly one third of the S&P 500.

Those stocks are sitting near the bottom of their range.

Not collapsing, but not driving.

The definition of dead money.

So you get what we’ve gotten.

A market where breadth holds it up from below, and leadership caps it from above.

Annoyingly….Balanced….Yin and Yang…..

My Two Cents

Balanced markets require discipline.

Be patient and wait for resolution.

Trade the range tactically with defined levels.

Or take controlled shots at pullbacks in strength with clear risk.

There is no edge in prediction here.

The edge is in defining your risk, sizing appropriately, and reacting when the market tips out of equilibrium.

Breadth is constructive. That keeps the floor in place.

But if this Bull Market is going to get back in gear, the starters have to wake up.

Leadership has to reassert itself.

Until then, expect chop. Respect the range. Stay flexible.

That’s the environment.

Anyway, that’s my two cents.

My Weekly Show – Thompson’s Two Cents

🚀 Throw it on 1.5x speed and let it rip.

👍 Give it a like. It’s the easiest way to show me some love.

FREE – The Sunday Stalk List | Ep. 35

If you want clean charts, clear setups, and tactical insights — this one’s for you.

It hits inboxes every Sunday so you know exactly what to keep an eye on for the week ahead.

Cheers,

Larry Thompson, CMT CPA

Sign Up For Thompson’s Two Cents