The most profitable part of a new market regime is how long it takes most investors to come around to it.

Humans are creatures of habit.

It’s not easy to just shift an entire mindset, especially one that was over a decade in the making.

“I’m a Growth Investor”

“There is no reason to invest outside the United States”

“Stocks & Bonds. What are Commodities?”

“Why would I invest in Gold, when I can own more Tech?”

“The government will never let Crude Oil get to $200”

These are all things people say and actually believe.

It’s taken a long time for people to convince themselves of these.

But over the years, I’ve learned (the hard way) that there is a time and a place for everything.

The bet we’re making is that people will continue to believe all those things mentioned above, until it’s too late.

But it’s already happening.

The bigger structural trends changed after Covid.

We have the data.

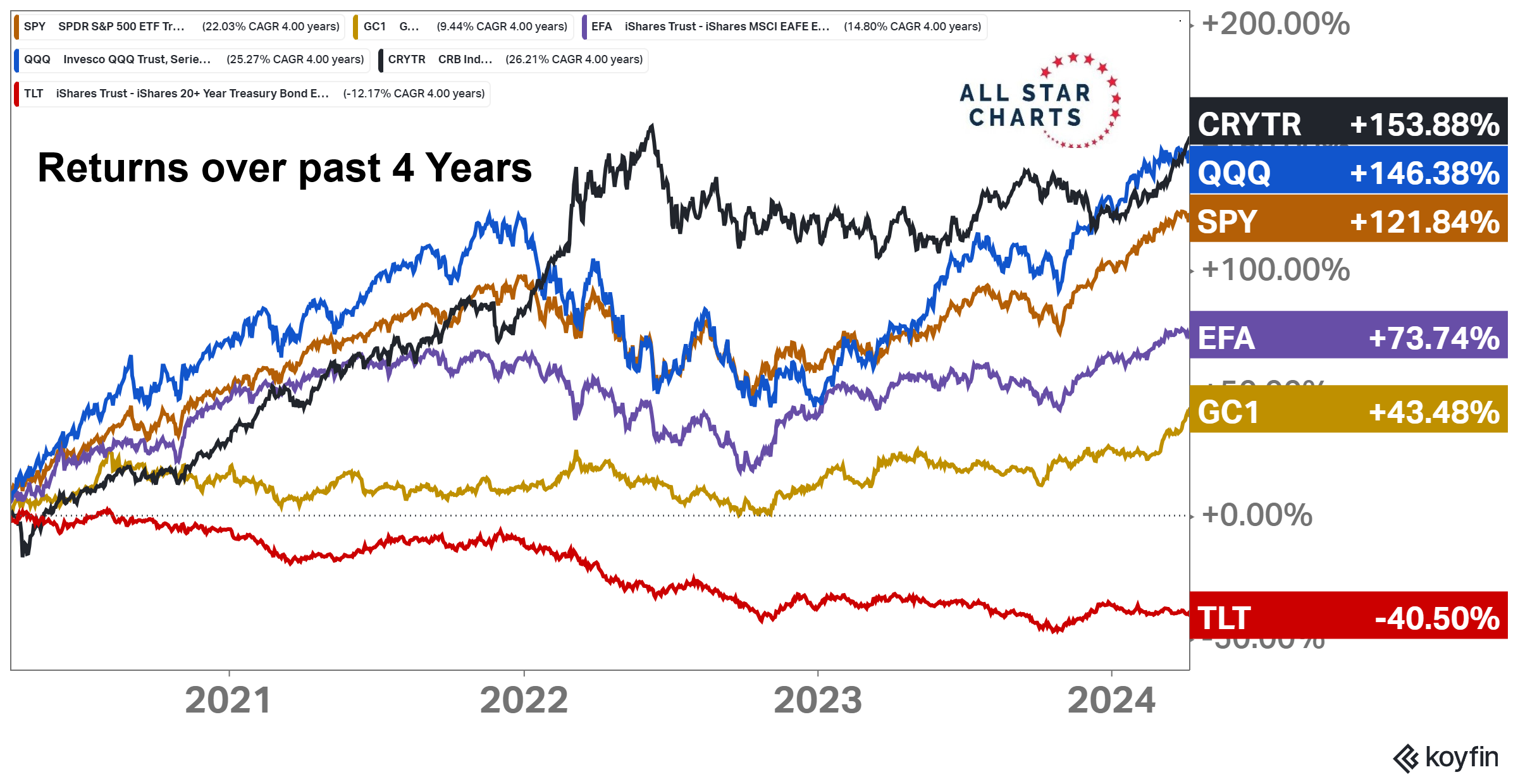

Look at the returns over the past 4 years, for example.

Even with the Nasdaq breaking records, it still can’t keep up with the returns of the CRB Commodities Index, which is dominated by Energy.

Also notice how poorly Bonds have acted, with the $TLT down over 40% on a total return basis, which includes the yield that it pays out.

It’s been a rough going for bonds.

But it’s going to be even tougher for investors who don’t have any exposure to Commodities.

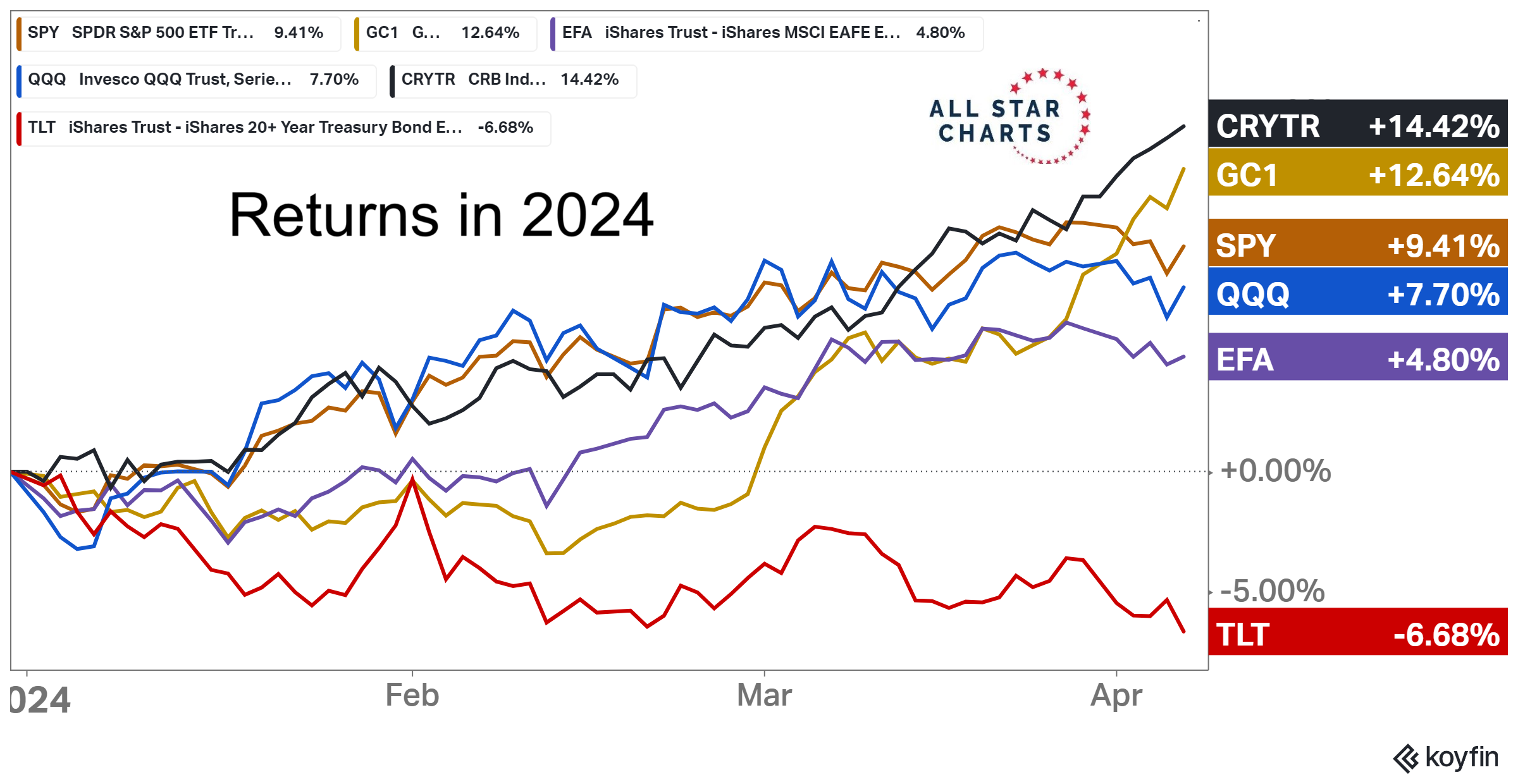

These are already the longer-term trends, as shown in the chart above, but you can see the exact same thing happening this year.

Commodities are running the investment world and Bonds are having a really really hard time:

Investors are NOT involved.

We know. We have the data.

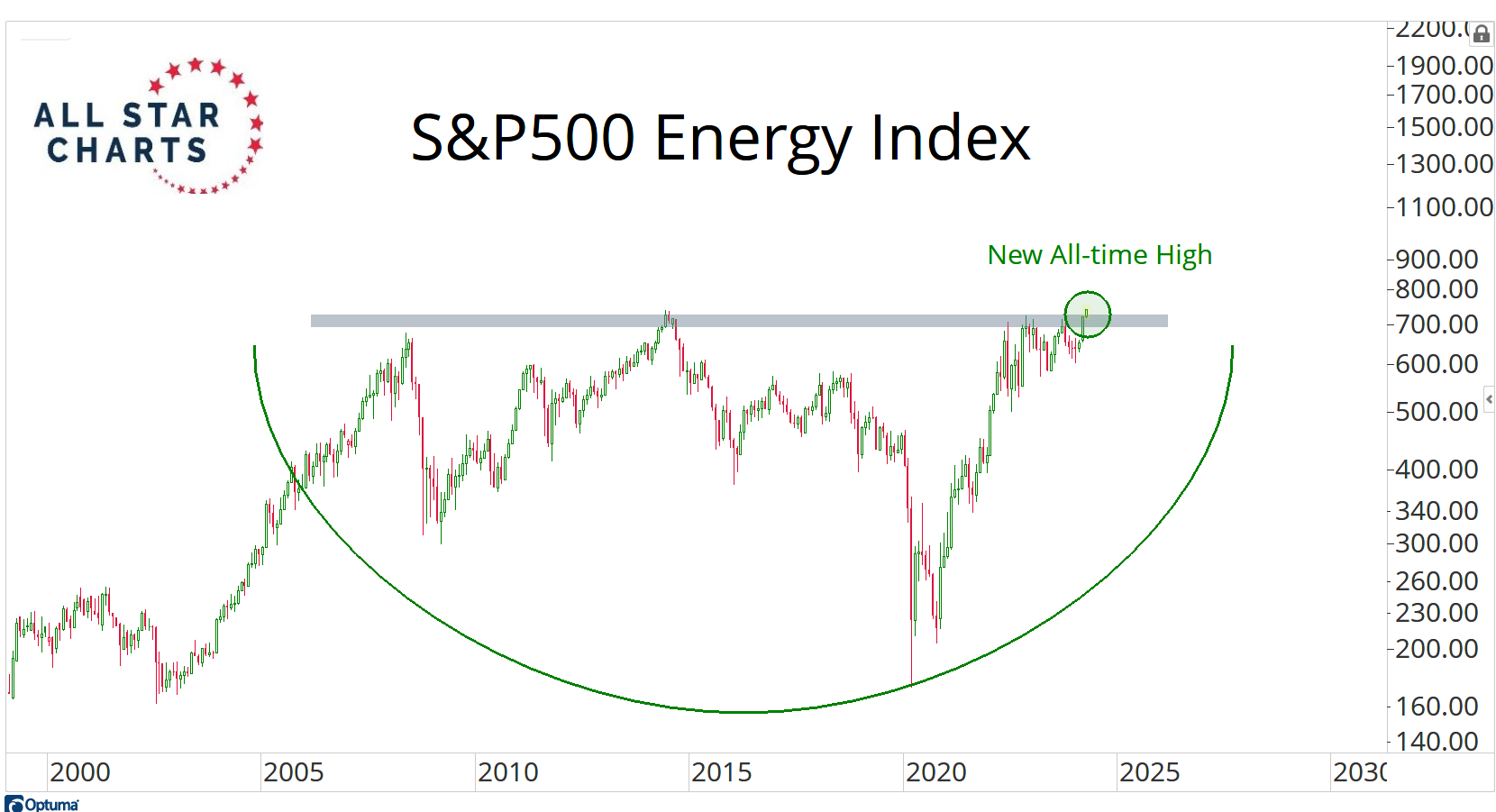

If you own the S&P500, you’re getting just 3% energy exposure.

If you own the Dow Jones Industrial Average, you’re getting just 2% energy.

And if you own the Nasdaq100 QQQ, then you’re getting a 0% weighting in energy.

Most investors are in this camp.

They’re not in.

What about you?

Are you taking advantage of the breakout in this 15-year base for Energy stocks?

Or are you closing your eyes are pretending that it’s not happening?

This is a historic breakout that no one is talking about.

But it’s already happening.

It’s here.

Investors are being distracted by narratives about AI stocks and what the fed is going to do next.

We’re focused on making serious returns.

And for Energy, we have a trade that I think can get us 30x profits.

Yes that’s 30x our money.

To do some quick math, a $1000 investment can turn into over $30,000 if we’re right.

$10,000 can turn into $300,000.

$100,000 can turn into over $3 Million.

We’re talking 30x.

You guys who know me well already know that I never say things like this.

I have no reason to. 30x trades like this never pop up.

But they did this week.

And members of All Star Options already have all the details.

I personally put the trade on and plan on buying more this upcoming week.

You can check out all the details and the full explanation of our Energy trade by signing up for ASO here completely RISK FREE.

As a Member of ASO you’ll get our Trade of the Decade, access to our LIVE member chat, 3 New Trade Ideas per week and a weekly video with Sean going over open trades in the portfolio.

Sign up here.

See you in there!

JC

The post Trade of the Decade appeared first on All Star Charts.