Vaxxinity (VAXX) – When Your Biggest Corporate Asset is a Private Plane

Dear OpTrackers,

I hope everyone is having a great holiday break. I noticed there is a dearth of content published during the week between Christmas and New Years, so I wanted to fill everyone’s inbox with the spirit of the season in the only way I know how – with a write-up of an amusing company!

Quick Business Summary

Today we’ll be taking a look at Vaxxinity (VAXX). Vaxxinity is ostensibly a biotech company focused on developing vaccines (utilizing their “Vaxxine Platform” technology) for chronic diseases. It shouldn’t be shocking to learn the company pivoted to this vaccine story during the year of our lord 2020 during the COVID pandemic. Having followed the small cap biotech space for a while, my priors tell me that “developing vaccines for X” when X is pathology that is not typically treated with vaccines (e.g. cancer, chronic disease) never or almost never works. So immediately our spider senses are tingling.

Vaxxinity People Overview

From the typical OpTrack perspective, the management and board of this company look relatively benign in terms of their track records. There is an absence of experience at public companies and thus an absence of public company success, but except for a handful of career board members they also haven’t been associated with prior scammy public companies that I can find. Nor have I found instances of anyone involved in the company being accused with wrong doing.

That said, the co-founders of the company are not exactly luminaries in the scientific field. It should also be noted that despite the different last names – they are married. Louis Reese (Co-Founder and Exec Chair) has an investment background and went to UPENN and then got an MBA. Mei Hu (CEO and Co-Founder) also went to UPENN and then got a JD from Harvard. She started her career with stints in management consulting and Big Law before ultimately becoming a partner at a venture fund. I am sure both of these people are exceptionally bright, but I would bet against them winning any science-related Nobel Prizes.

The Board of Directors is also composed 7 individuals where three of them look like metaphorical empty shirts – professional board members with little-to-no biotech expertise to speak of.

The most interesting thing to note from a people perspective is that the company does not have a CFO. The company does have an SVP of Finance and Accounting, Jason Pesile who previously held a similar role at ElectroCore (ECOR) which is down >95% from its IPO and two other biotechs that didn’t go well in BeyondSpring (BYSI) and Progenics Pharmaceuticals (PGNX). But that’s not a senior enough role for me to really hold it against someone and Jason appears to have left the company 2 years prior to the IPO.

The lack of a CFO gets even more interesting when you consider the following:

-

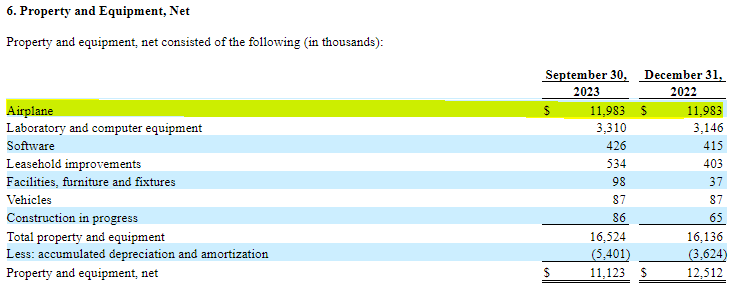

The company’s single largest non-cash and equivalent asset is a private airplane

-

This biotech company trying to change the world with their vaccines has >2.5x as much invested in a private plane as they do lab equipment

-

This private plane represents approximately two-thirds of the company’s total gross assets (excluding cash)

-

-

The company has a going concern disclosure in their filings

-

The company is burning ~$50mm/year against ~$43mm of gross cash and ~$30mm of net cash

-

I believe this company exists solely as a way for the married founders to have access to their own plane that they can pay for by raising money from the public markets. This will continue to work until it doesn’t, likely with an ever-growing share count.

Happy holidays again and see you in the New Year!

Disclaimer: As always please remember nothing written in this blog should be considered investment advice. You should assume that even though we tried our best that this post is riddled with errors and do your own research/consult a licensed financial advisor before investing any of your own money into any financial security.