Wednesday

STOCKTWITS CHART ART

The Stocktwits Summary 📝

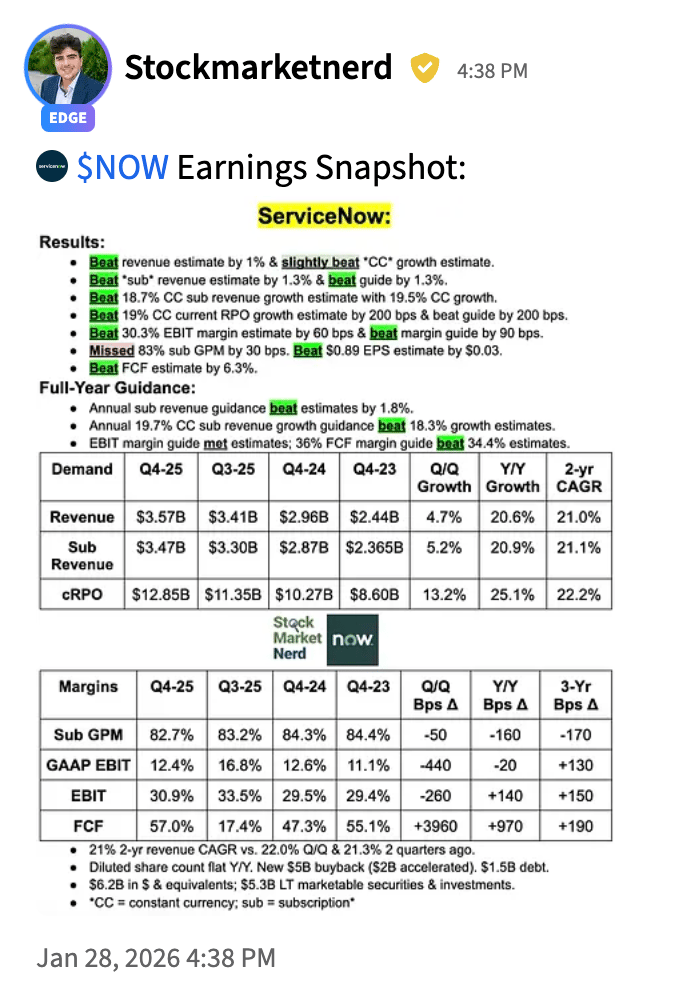

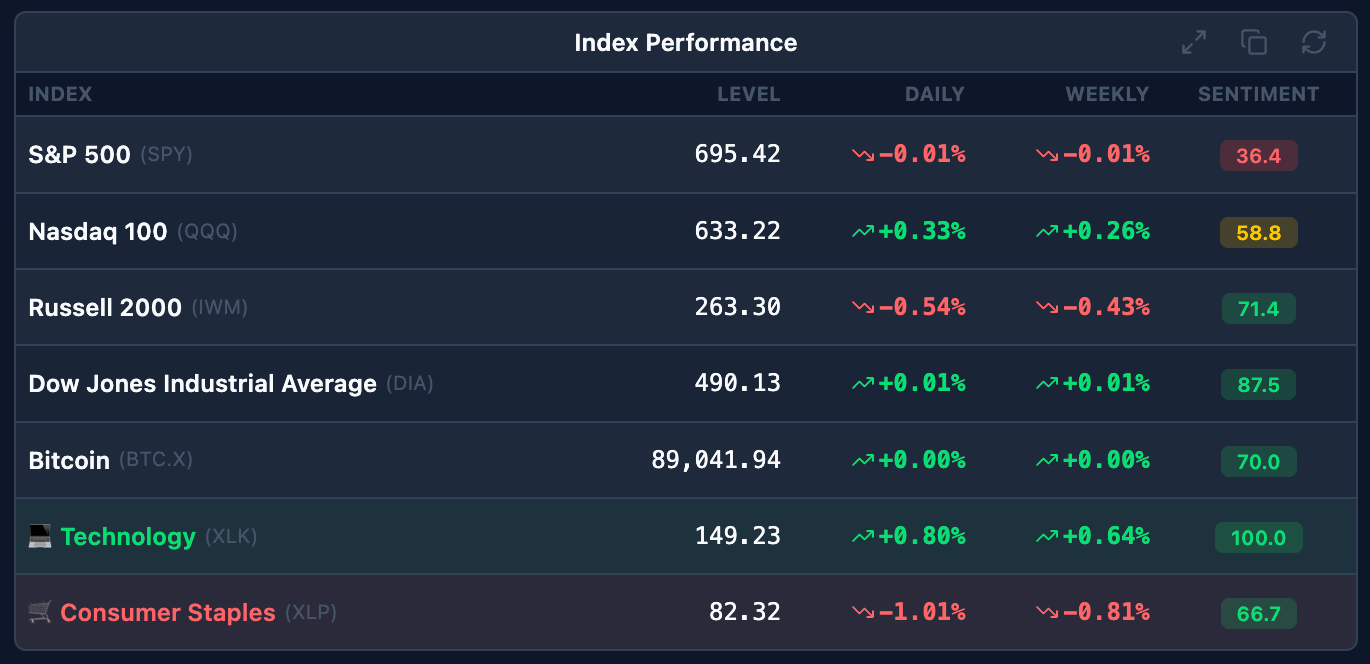

Wednesday ⚖️: The Federal Reserve held interest rates steady at 3.50% to 3.75%, sparking a “wait-and-see” mood that sent gold and silver to historic highs. While the S&P 500 and Nasdaq touched record levels, mixed earnings from the “Mag 7” saw Tesla pivot toward robotics and Microsoft slide 7% on massive AI infrastructure spending. Small-cap momentum remained stalled as investors weighed heavy capital expenditures against a stabilizing labor market.

*The ST Sentiment Score & Message Volume scales range from 0 to 100 (extremely bearish to extremely bullish). More info here.

Email me (Kevin Travers) with charts! Message me charts @kevinbtravers

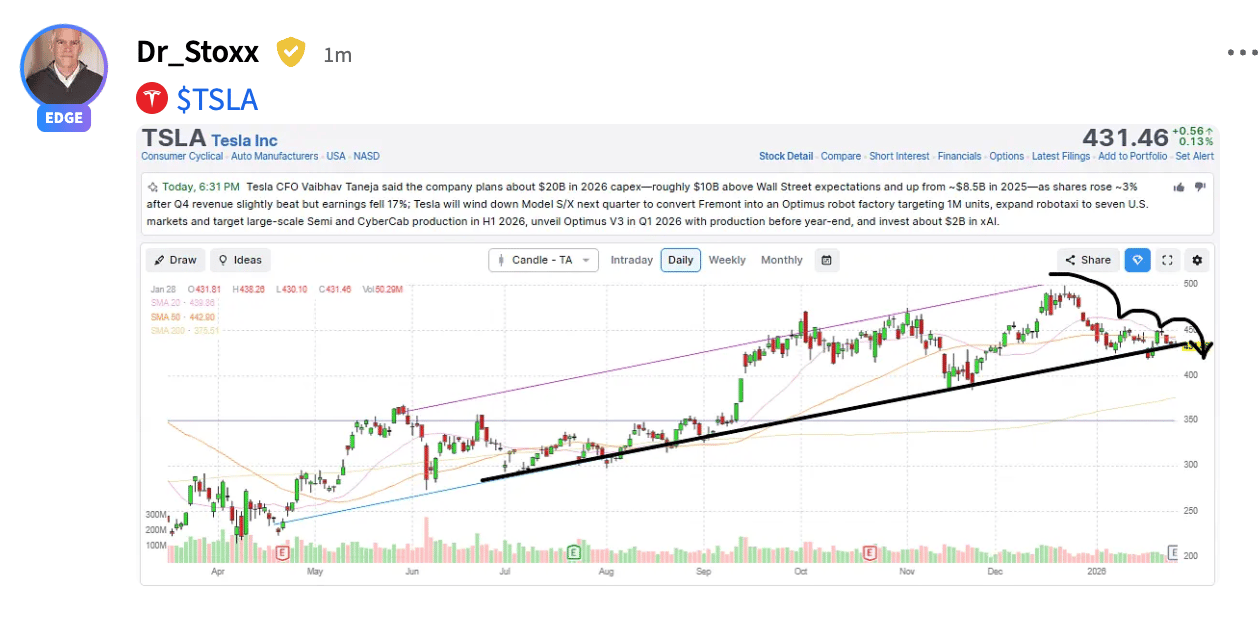

Tesla rises 3% post-earnings as $TSLA outlines $20B CapEx for 2026, Optimus V3 rollout, and robotaxi expansion 🟥🤖

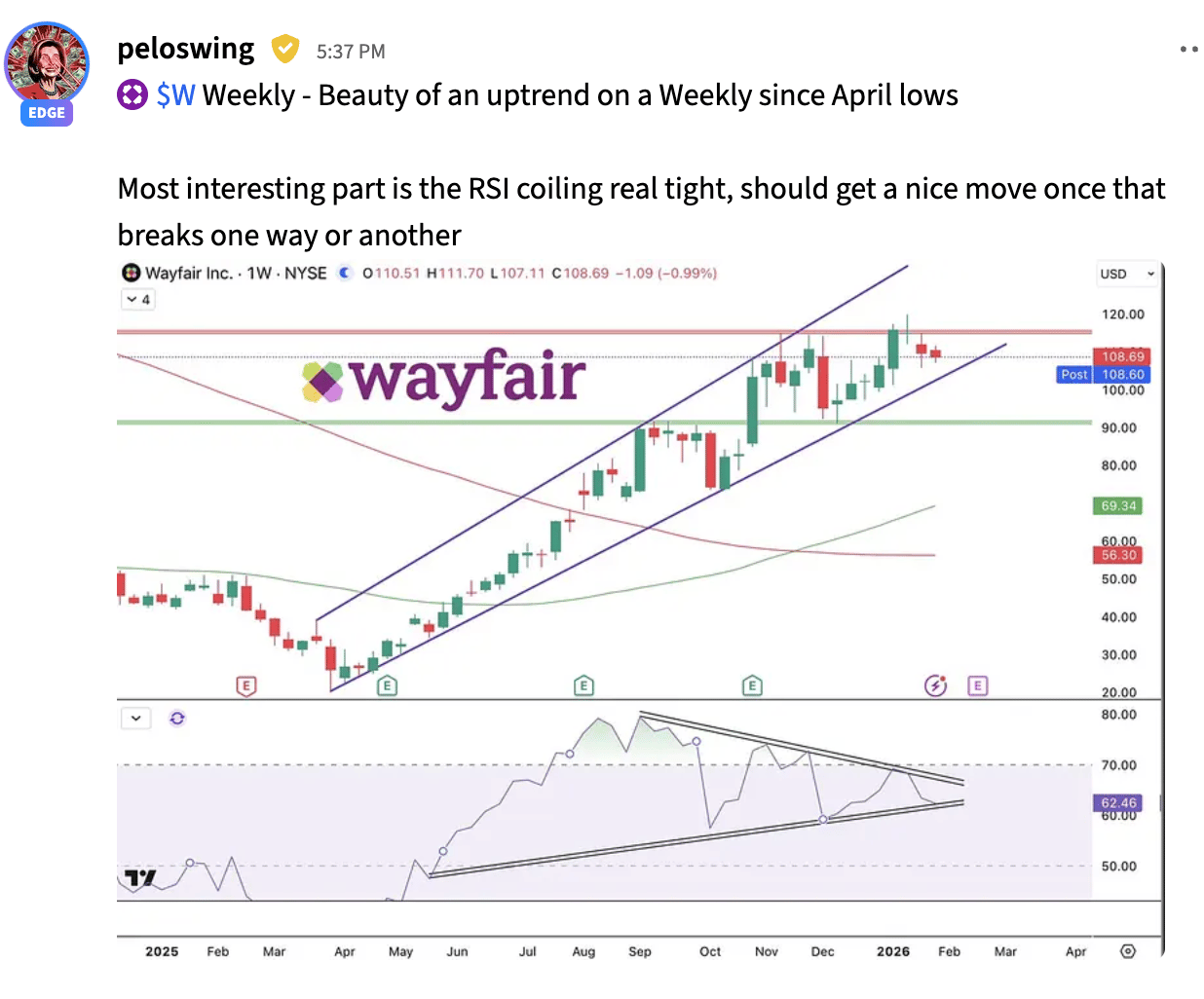

Wayfair grinds higher in weekly uptrend as $W RSI coils tightly near 62, setting up breakout volatility 🟣📈

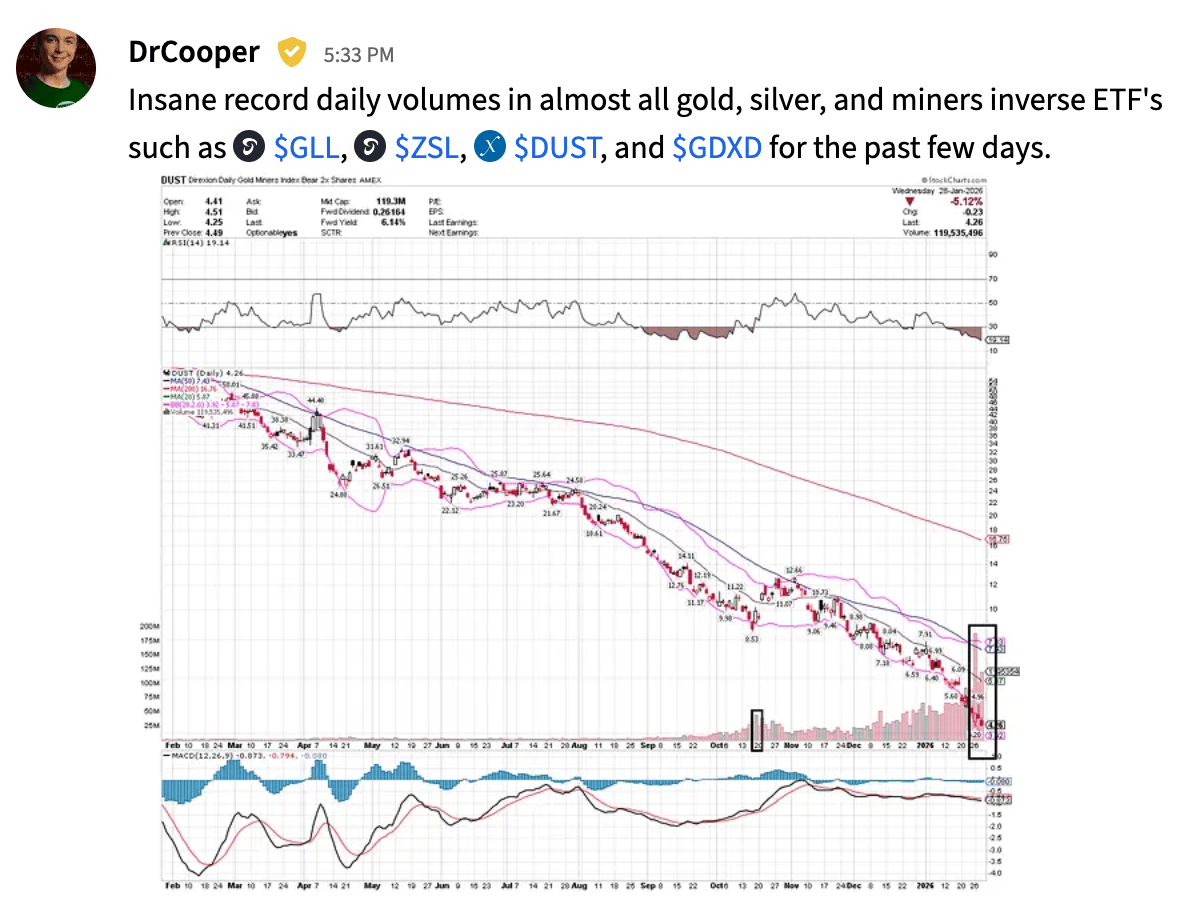

Inverse gold miner ETFs hit record volume as $DUST plunges to 4.26 with Bollinger compression and MACD divergence 🟡📉

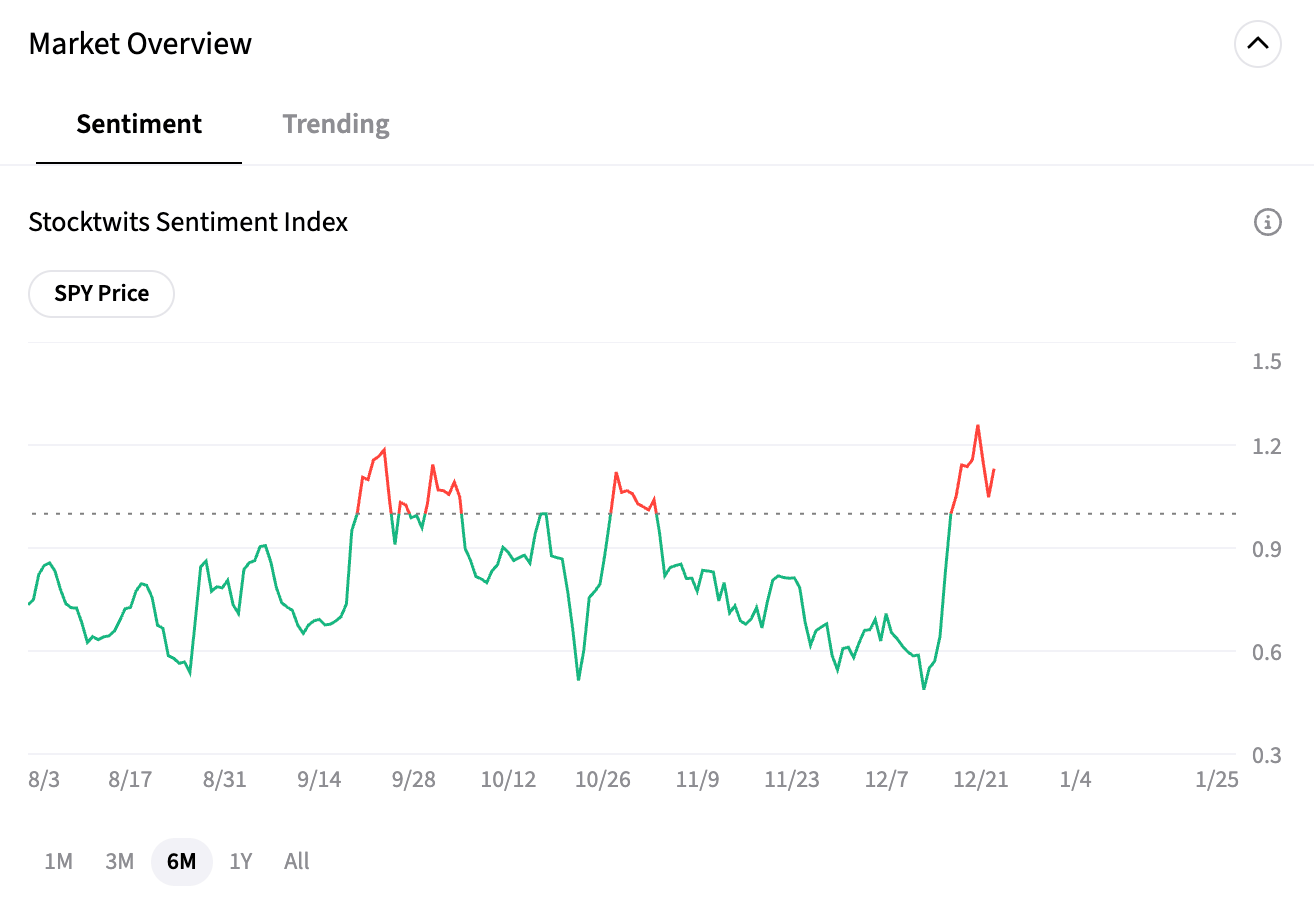

STOCKTWITS SENTIMENT INDEX

How Is The Market Feeling?

TIRX surges 311% intraday as shorts scramble to cover, retracing 40% with VWAP magnet at 1.13 and scalp setups active 🟥⚡

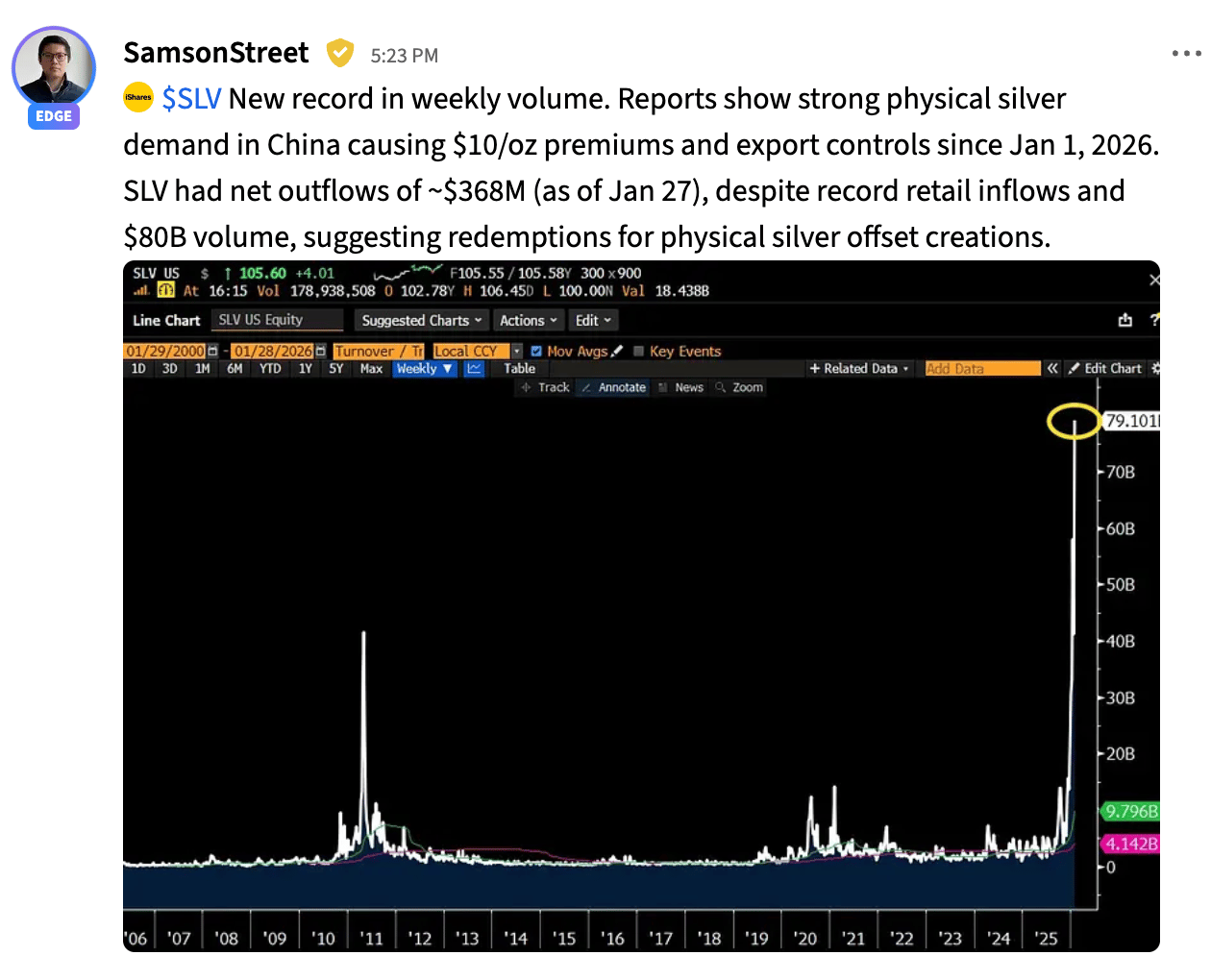

Silver ETF $SLV hits record weekly volume at $79B as China’s physical demand drives $10/oz premiums and export controls 🟠🥈

STOCKTWITS VIDEO

Latest from Stocktwits video: LIVE FROM NEW YORK, ITS… Wednesday afternoon 😂

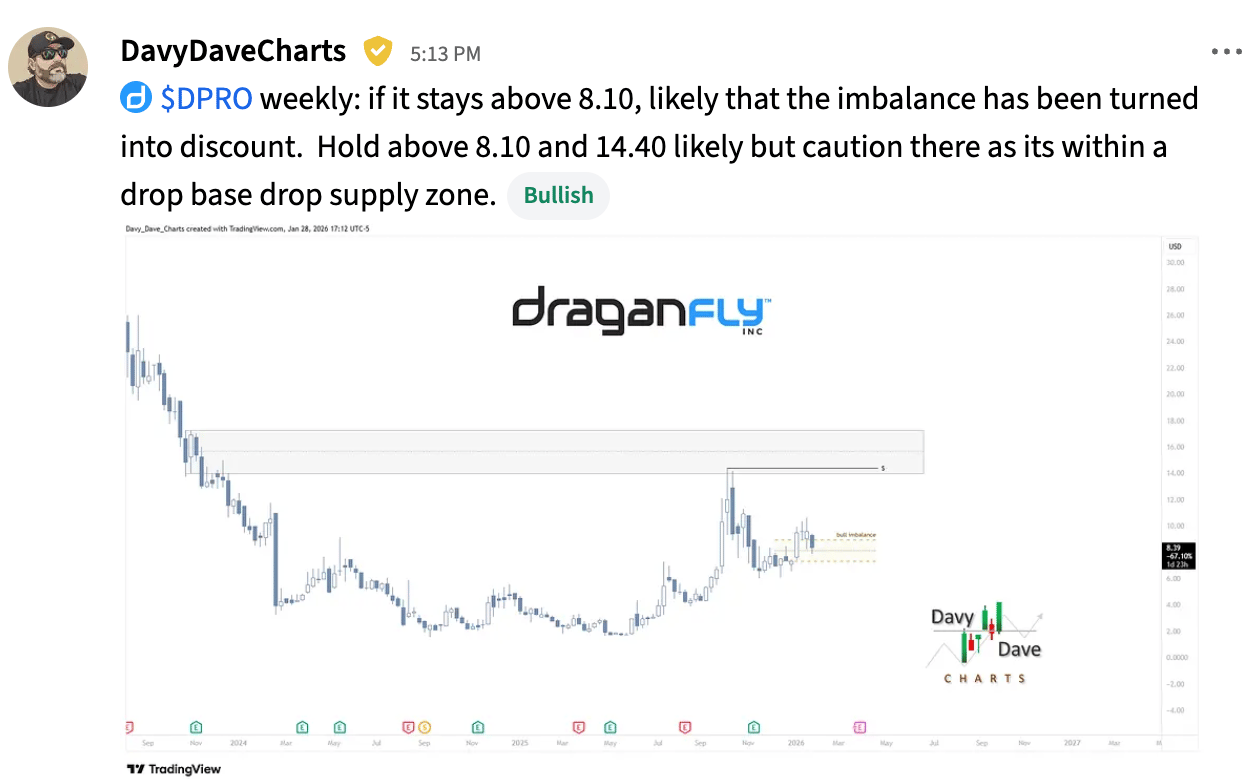

Draganfly holds above $8.10 as $DPRO tests supply zone with bullish imbalance and weekly support confirmation 🟢📊

Get In Touch 📬

Email me (Kevin Travers) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach thousands of chart enthusiasts? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋