Well, Hello Alt Season 👋

OVERVIEW

Well, Hello Alt Season 👋

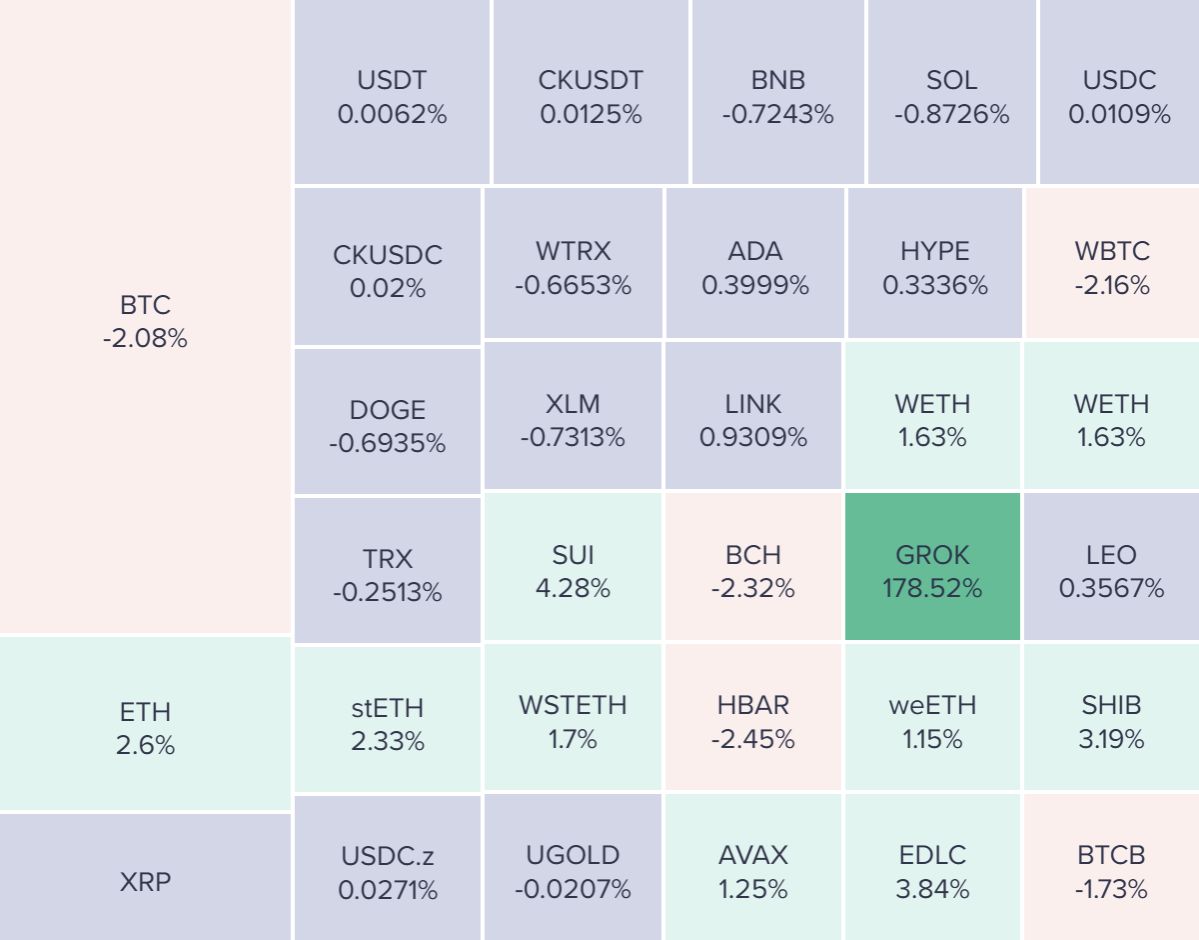

Before we dive in, here’s today’s crypto market heatmap:

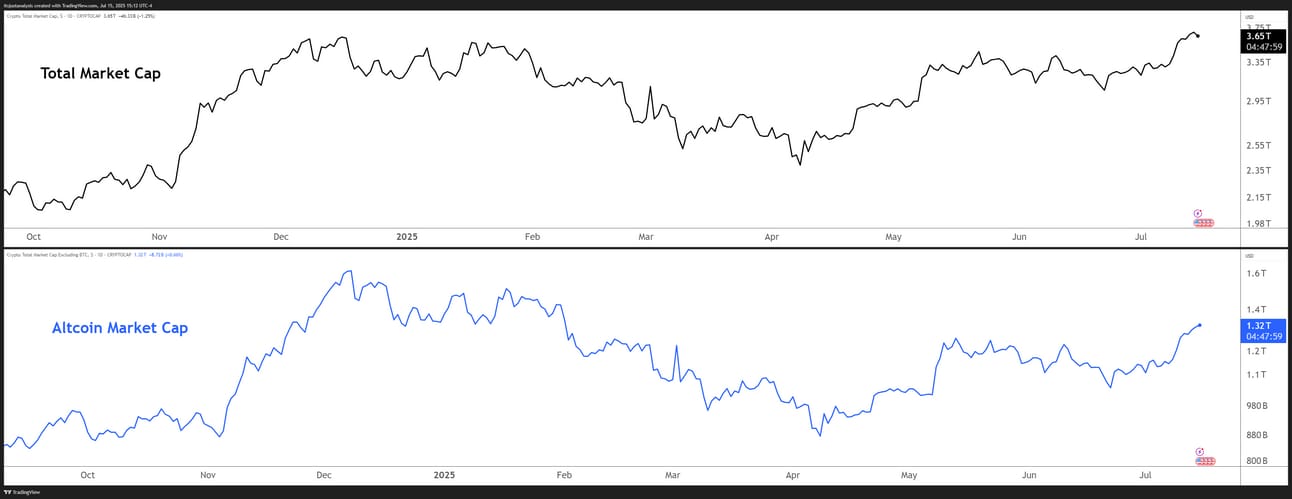

And here’s a look at crypto’s total market and altcoin market cap charts:

NEWS

Crypto Week Turns Crypto Weak 🤦

13 GOP rebels joined Democrats to kill the rule that would’ve teed up three shiny crypto bills, yanking the floor out from under his self-styled “Crypto Week.” 😢

What Just Happened

-

Procedural vote: 196-223 – needs a redo before anything moves.

-

Bills on ice:

-

GENIUS Act – stablecoin guardrails

-

CLARITY Act – market-structure split between SEC/CFTC

-

Anti-CBDC Act – straight-up bans a digital dollar

-

-

Freedom Caucus says: “No CBDC ban? Hard pass.”

Why it matters

House leaders thought procedural votes were a formality – even the crankiest members usually hold their nose and press “Yea.”

Not today.

Their revolt forces Speaker Mike Johnson to either bolt the bills together (guaranteeing Senate gridlock) or sweet-talk the hard-liners before the next attempt at 5 p.m. EST.

What’s Next

Johnson swears a do-over vote is coming – even sometime this evening, but stitching extra anti-CBDC language into GENIUS could force the Senate to reread the whole thing. 🤷♂️

TECHNICAL ANALYSIS

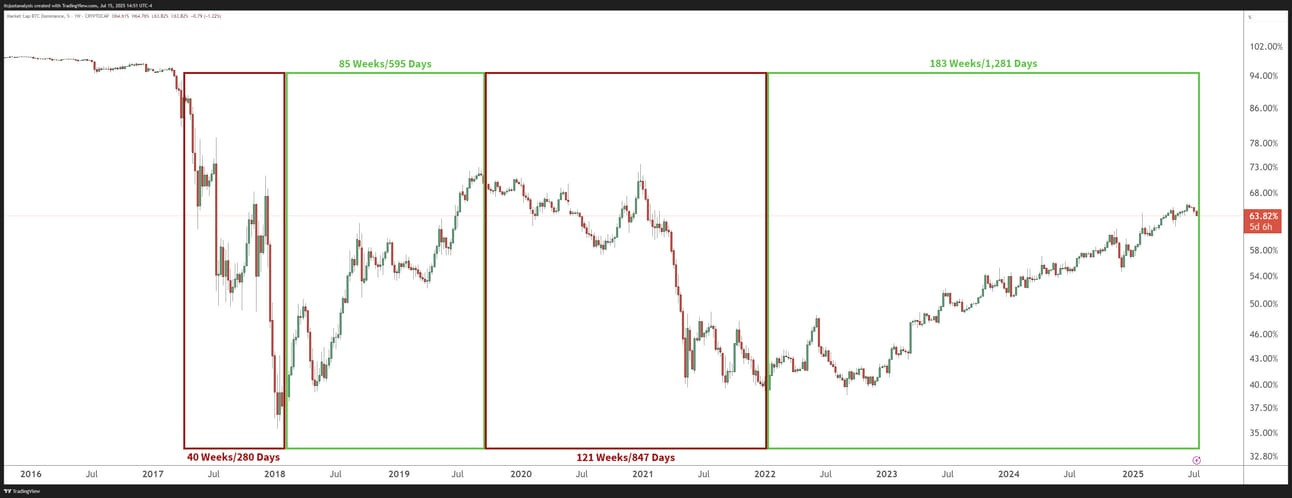

BTC’s Dominance Is Nearing Collapse Conditions 🍂

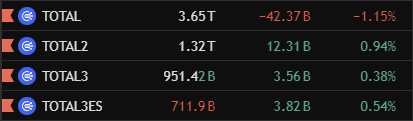

Take a look at the screenshot below:

-

TOTAL = total crypto market cap

-

TOTAL2 = total crypto market cap excluding BTC

-

TOTAL3 = total crypto market cap excluding BTC and ETH

-

TOTAL3ES = total crypto market cap excluding BTC, ETH, and Stablecoins

All are in the green – except the total market cap. This might seem odd given Bitcoin’s market cap accounts for over 60% of the entire cryptocurrency market’s market cap.

At the time of this analysis (1430 EST), Bitcoin is down -2.73% and trading near $116,500. Ethereum, however, is up +2%. Other major altcoins, like Sui are up +4%.

As a result, Bitcoin’s Dominance chart is falling hard, returning to levels not seen since May. And today’s drop is the biggest drop since May 10, 2025.

Wen Alt Season? 🤔

An altcoin market that is appreciating while Bitcoin underperforms is the kind of condition veteran crypto people call ‘Alt Season’. Now, some readers might disagree with this, but there’s only been a couple ‘Alt Seasons’.

The first Alt Season was the ICO craze in the second half of 2017 until early Q1 2018.

It took 85 weeks for the crypto market to recover enough for alts to even begin to show some life again. The second Alt Season began, roughly, in late September 2019. But even then, most of the gains altcoins saw began in January 2021 and stopped a year later in January 2022.

And that brings us to where we are now. Since 2022, the altcoin market has suffered, and suffered badly. Altcoin hodlers and traders have waited 1,281 days (3.5 years) to experience the same kind of love BTC has received over the years.

Is their time now? Could be. The timing, conditions, and environment have been the most favorable at anytime in crypto’s history. Let’s see what happens. 👀

NEWS

CoinDesk Journo Says Feds “Weaponised” His Old Group Chat 😱

A CoinDesk reporter, Danny Nelson, caught the Justice Department dangling a Telegram chat as smoking‑gun proof – then realized the chat wasn’t written by Tornado Cash dev Alexey Pertsev at all. 🤦

Instead, it was another journalist spit‑balling how the Axie Infinity hackers might launder $600 million, and the line got lazily slapped under Pertsev’s name. Storm’s defense pounced, asking Judge Failla to toss the exhibit and peek under the grand‑jury hood for more sloppy “mistakes.”

Prosecutors coughed up an apology, blaming a formatting hiccup, yet still argued the chat “is authentic” and begged the court to ignore the whole who‑wrote‑what snafu. 🤦♂️

Big Picture

If the exhibit gets nuked, it dents the narrative that Tornado Cash devs knowingly helped North Korean hackers cash out. More importantly, it spotlights a pattern: bureaucrats wielding half‑baked tech receipts against open‑source builders while pretending it’s just “evidence.”

A conviction could set the precedent that written code is not free speech and anyone who uses your code makes you liable for whatever shenanigans someone uses it for. But if the jury smells prosecutorial amateur hour, Storm might skate – or at least win a mistrial. 🕵️

STOCKTWITS RETAIL RADAR

Small-Caps Succumb To Souring Sentiment ($IWM) 🛑

Last Friday, we showcased Stocktwits Sentiment and Message Volume data that suggested retail’s enthusiasm toward small-cap stocks was waning. Now that prices are starting to turn lower, let’s see how retail is positioning itself. 👇️

In mid-June, $IWM sentiment peaked and signaled a divergence after failing to reach new highs alongside prices. Last week, sentiment pushed firmly into ‘Bearish’ territory, suggesting retail expected a pullback after this record run.

With today’s move lower, sentiment touched its most bearish level since April, but message volume remains subdued. This could signal that more downside is needed to reach “peak fear” levels. 😬

When combining this with the technicals, Russell 2000 futures are pulling back from a key area of support/resistance near 2,300. The Relative Strength Index (RSI) confirmed a divergence, and today’s fall was the largest since May. 🧐

Source: TradingView

The long-term trend remains intact for investors, but retail is positioning for a ‘pause that refreshes’ after a record run. We’ve shifted from an environment where broad-based index exposure dominated to one where retail participants are becoming more selective in the stocks they’re playing. At least for the short term.

Add $IWM to your watchlist to monitor this trend reversal. More importantly, to source these sentiment insights yourself, subscribe to Stocktwits Edge to unlock all the historical sentiment data for equities and crypto. 🔓️

*This real-time Stocktwits Sentiment use-case example was curated by Stocktwits’ Editor-in-Chief, Tom Bruni, and is solely for informational and educational purposes. Tom does not hold any positions in the Russell 2000 as of the time of publishing. For any questions or comments, please email tbruni[at]stocktwits[dot]com.

NEWS

Polymarket In The Clear 😥

Turns out the Beltway’s crypto cops just walked away from Polymarket. 🎰

-

Who got ghosted? The DOJ and CFTC. Their probes – sparked by a 2024 election‑night betting frenzy – quietly wrapped this month, no charges, no new fines.

-

Remember the tab? Polymarket already cut a $1.4 million check in 2022 and promised to fence out U.S. punters, yet FBI agents still kicked in CEO Shayne Coplan’s Soho door last November.

So why the sudden kumbaya?

Trump‑era regulators are busy pitching crypto‑friendly rulebooks and pushing Congress to finish “industry‑backed” legislation. Brian Quintenz (ex‑a16z, ex‑Kalshi board) has the CFTC nomination, and prediction markets want a seat at the grown‑ups’ table.

The clean slate lands at a handy moment. Polymarket is hunting a $200 million round led by Peter Thiel’s Founders Fund, pegging the upstart at a cool billion‑plus. Cash like that buys lawyers – and maybe a licensed path back into the U.S. if they grab or build a CFTC‑blessed futures exchange.

Net result: the “illegal swaps” boogeyman faded, the fundraising roadshow looks shinier, and prediction nerds can quit refreshing Coplan’s docket. ‘Bet’ on more U.S. market action soon 🤞

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

🤖 ASI Alliance Wants Your AI Agents Talking Faster Than You Do

Fetch.ai, SingularityNET, and Ocean stitched ASI to sell us digital Jeeves that book flights and maybe steal jobs. The ASI:One v1.0.6 release brings async agent comms, mobile-desktop parity, and a fly-wheel marketplace so devs and users feed each other’s addiction. Competitors are megacorp LLM silos, but ASI bets its open uAgents framework and Agentverse will lure both compute and talent. Artificial Superintelligence Alliance.

🌓 Midnight Marries Privacy While AR.IO Promises Forever Storage

The duo will blend Midnight’s shielded smart contracts with Arweave-backed permanence so your data can hide and still never die. Dev-ready APIs and Compact language docs are on deck to let builders stash both public and encrypted payloads natively. Great – now your incriminating files can be private and immortal, like the internet always dreamed. Arweave.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending Protocol News 🏦

📈 dYdX Waves $10K Carrot for PUMP-USD Degens

From July 15 to 28, top PUMP-USD traders on dYdX can snag up to $3,000 for PnL glory or $400 for sheer volume. Finally a chance to brag about realized PnL instead of the screenshots you forgot to timestamp. Leaderboard winners announced on X, prizes in wallets within 30 days, but, booooooo, U.S. traders need not apply. dYdX.

🦅 API3 Plans to Out-Oracle the Oracles by Ditching Middlemen

Co-founder Burak Benligiray says rival oracles burn treasuries on partnerships, wash-trade OEV, and basically run a slow-motion exit scam. API3’s strategy is first-party data feeds and transparent OEV kickbacks to dApps to build an actual moat. Sounds cute – until Chainlink learns to spell “disintermediation” without a branding deck. API3.

LINKS

Links That Don’t Suck 🔗

🤯 Wall Street’s BlackRock, JPMorgan, Wells Fargo and Citi post record-shattering earnings

⏩️ SWIFT eyes Ripple (XRP) or HBAR for fast inter-bank transfers

💶 BofA FMS: Investors most overweight Euro since January 2005

😶 $100M investor in Trump’s World Liberty Financial denies links to banned Chinese market maker

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Email me (Jonathan Morgan) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of crypto enthusiasts? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in ADA, IMX, COPI, MIN, AGIX, ALGO, ZEC, XLM, and NEAR. 📋