Wow what a difference

Everything changed in February.

You started to see the cracks in January, but the big changes in market dynamics really got going in early- to mid-February.

And then March came, when everyone else saw it.

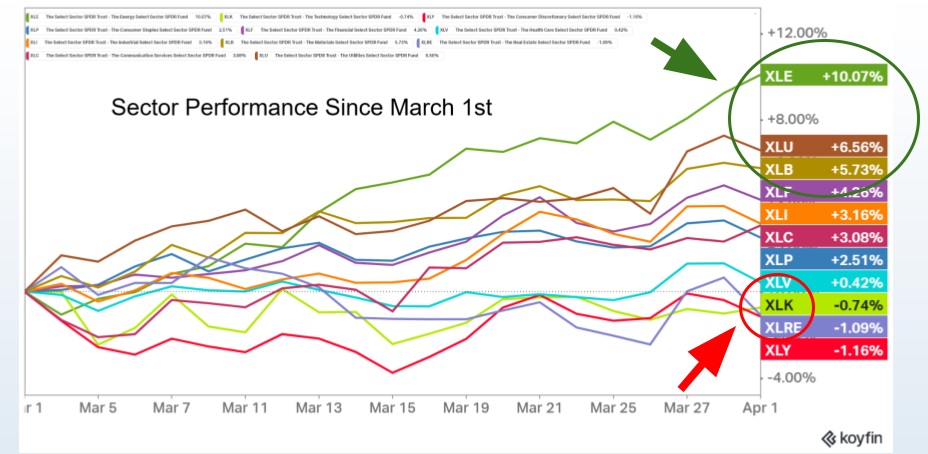

Look at the Sector Performance last month, for example.

Energy stocks were up double digits.

Technology stocks were DOWN.

Consumer Discretionary stocks were DOWN.

The sectors with the largest weightings in the most popular indexes are the worst performing stocks.

The sectors with the smallest weightings in those indexes, and in many cases no weighting at all, are the best performing stocks.

Have you adapted to the changes in this market? Or are you still incorporating those strategies that were working last year?

It’s not too late.

I think these new trends are just getting started. Expect to be talking about our new leaders all year, and even into 2025.

So what are we doing about it? What’s the best way to take advantage of this rotation?

We discussed it all in great detail last night during our LIVE Monthly Charts Strategy Session.

Premium Members check out the full video, download the slides, and review the new trades here.

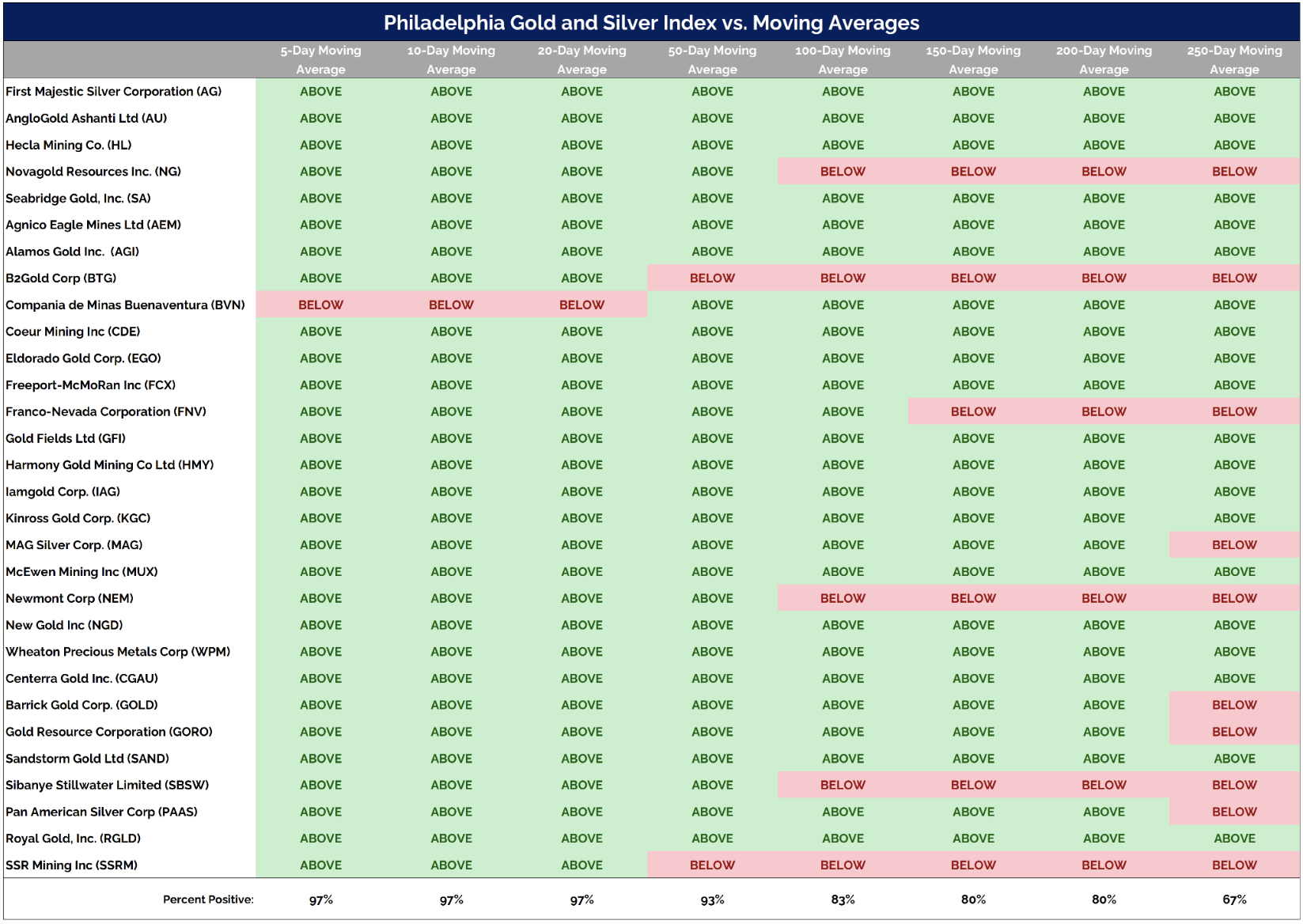

One of the slides that stood out the most to me during last night’s LIVE Conference Call was the amount of Gold and Silver stocks in uptrends.

This isn’t something you see too often.

On the left side of this table below is a list of all the stocks in the PHLX Gold & Silver Index, which is one of the more old school precious metals indexes.

Notice at the top of the table you’ll see a series of moving averages, from the 10-day all the way to the 250-day.

If the cell is Green then the stock is above that moving average. If the cell is Red then the stock is below it.

Notice how much green you see in this table. That means all these are NOT downtrends:

Quite the opposite actually.

This is the pond we want to be fishing in during this type of market environment.

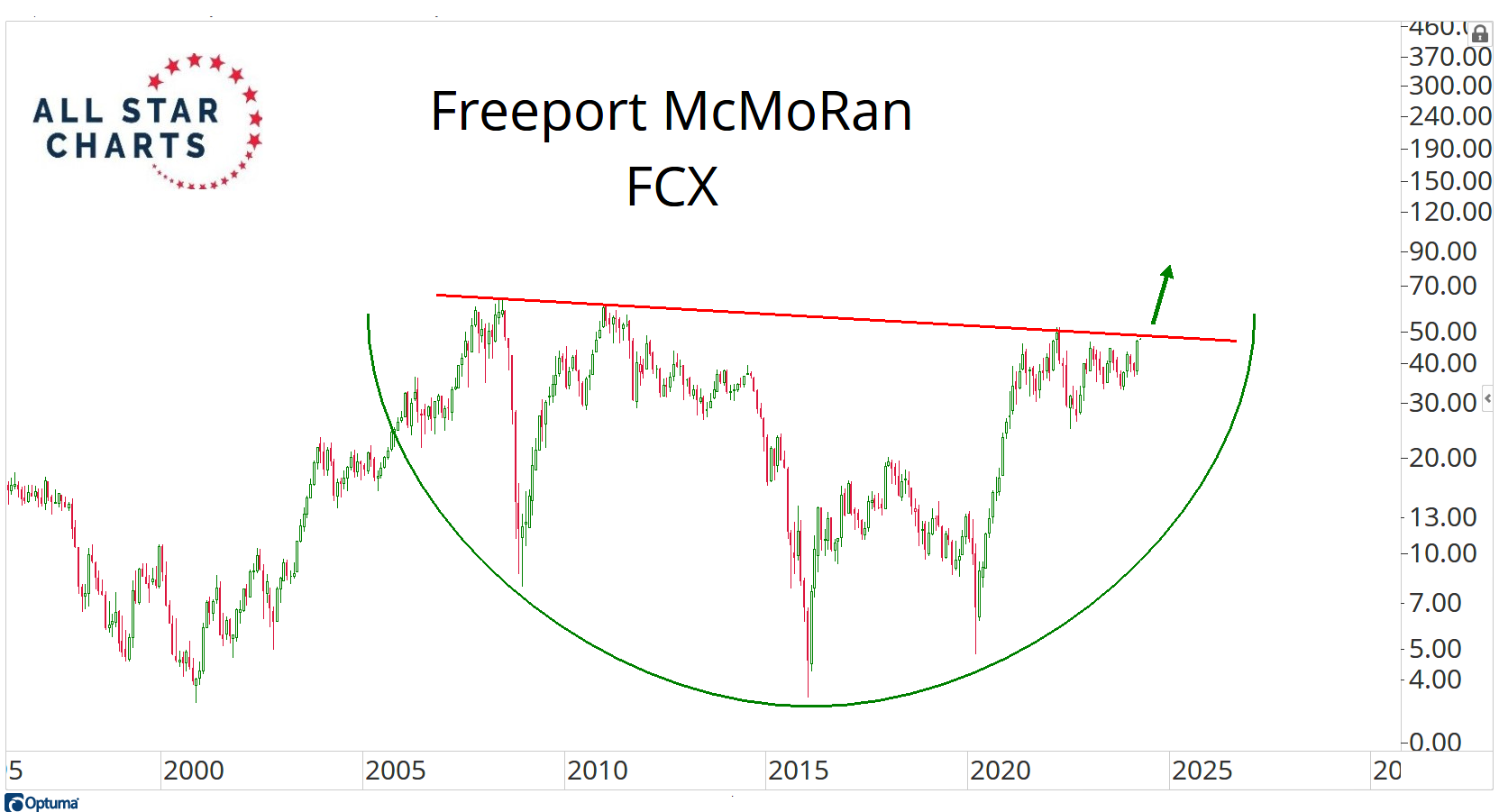

And as we’ve discussed, this isn’t just a “Precious Metals” story. This is a Metals story.

Freeport McMoRan gives us exactly that – exposure to metals:

As usual, the best way to express a bullish view is through the Options Market.

In this case, we bought Call Options that don’t expire until next January. But since they’re a little expensive, we helped pay for those by selling the May Calls.

It’s an easy trade.

If volatility was lower in this name and the January Calls were cheaper, then we wouldn’t have to sell the May Calls to help pay for them.

But in this case we do.

That’s the type of special twist we like to put on when we have Sean to turn to for all our trades.

I never put on an options trade without first getting the advice of our Chief Options Strategist, Sean McLaughlin.

This is a privilege because I’ve never met anyone who writes up a trading plan—the entry, the exit, the timing—like Sean.

Don’t believe me? Come see for yourself.

This Wednesday at 3:00 pm ET, Sean is hosting the Options Execution Lab, where he will be walking through step-by-step how he goes from idea to trade, including how he selects:

- The stock

- The options strategy

- The strike(s)

- The expiration(s)

This is a premium event that’s only for members of All Star Options. Just to reiterate – there will be a NEW trade, we will walk you through exactly HOW TO PUT IT ON, and you’ll get the skinny on how to find the next one.

You can join All Star Options and get access to the Options Execution Lab by clicking here.

JC

P.S. This is a risk-free trial, and the current offer expires on Wednesday. So act now.

The post Wow what a difference appeared first on All Star Charts.