AI: OpenAI's 'Gotta Wear Shades' moment. RTZ #816

The Bigger Picture, Sunday, August 17 2025

The last two weeks saw ;a fairly dramatic major launch of GPT-5 by OpenAI. The long-anticipated product was finally released, and as I recounted a few days ago, user reactions drove some product adjustments. And there are a lot of disparate opinions on the quality of the the release, and that is the Bigger Picture worth considering this Sunday.

The critics have gone louder since that ‘re-tweak’, and some are running ‘I Told You So’ Victory Laps. But the glass is more than half full for OpenAI, and it’s useful to hear founder/CEO Sam Altman’s take and positioning, after a tumultuous few days. And insist of course, that the ‘Future’s so bright, you gotta wear shades’, to paraphrase the famous 1986 song by Timbuk 3.

Axios lays out OpenAI’s position in “Sam Altman: Never mind the launch mess — full speed ahead”:

“OpenAI CEO Sam Altman is still talking like the future belongs to him, a week after the rollout of the company’s latest model raised a storm of criticism and questions about his strategy.”

“The big picture: Altman has heard the concerns, integrated some lessons learned and is charging forward with plans to spend literally trillions of dollars to build a slew of products and services, led by an even more ubiquitous ChatGPT.”

The argument from his perspective is relatively sound, with some dramatic projections:

“What he’s saying: “If you project our growth forward, pretty soon, like billions of people a day will be talking to ChatGPT,” Altman said during a wide-ranging dinner with a small group of reporters in San Francisco Thursday night.”

“ChatGPT will say more words a day than all humans say, at some point, if we stay on our growth rate.”

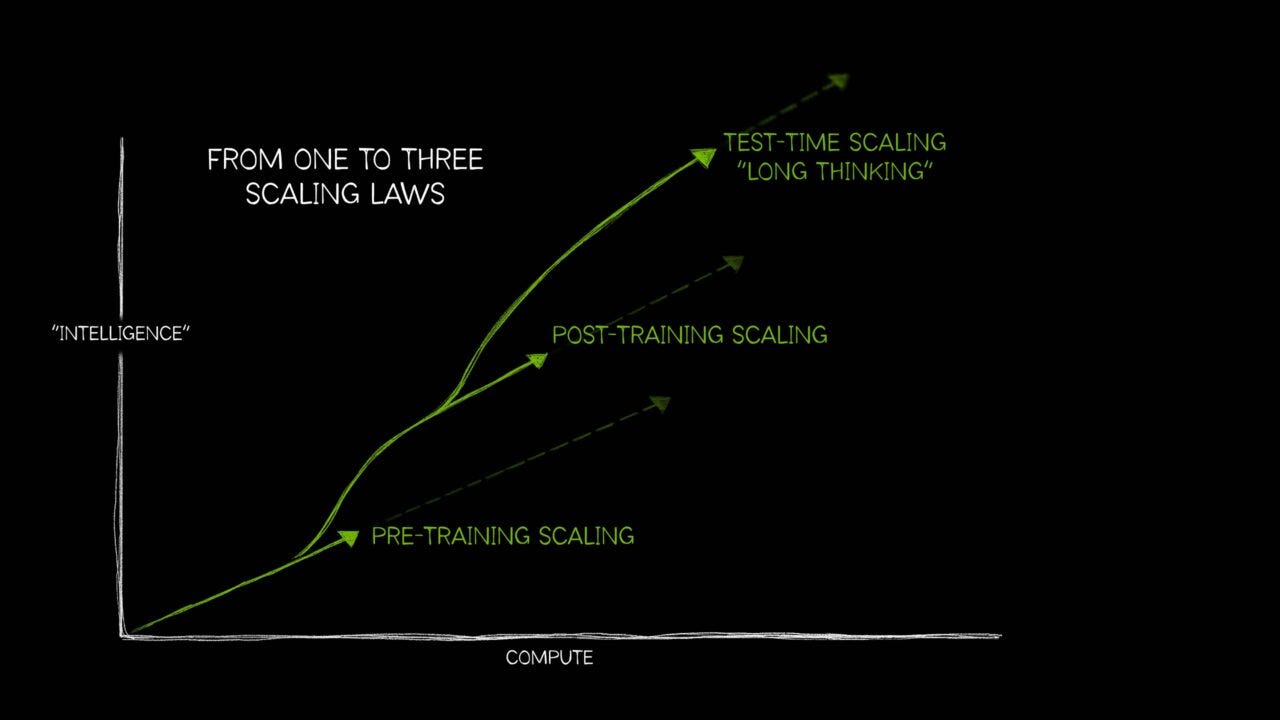

But as the saying goes, ‘you gotta spend money to make money’, given the dynamics of ‘AI Scaling’:

“These big plans require big spending.”

“You should expect OpenAI to spend trillions of dollars on data center construction in the not very distant future,” Altman said.”

“And you should expect a bunch of economists to wring their hands and be like, ‘Oh, this is so crazy. It’s so reckless,’ and whatever.”

“And we’ll just be like, ‘You know what? Let us, like, do our thing.'”

His peers are of course doing the same. And need no convincing.

Altman acknowledges that the company may have to devise new fundraising structures to gather that level of investment.

“I suspect we can design a very interesting new kind of financial instrument for financing compute that the world has not yet figured out,” he said.”

“Altman’s defense of OpenAI’s billions in infrastructure spending is that it pays off.”

“Our answer is, we can spend $300 billion and sell $400 billion in services, and if we don’t have the $300 billion in data centers, we just keep disappointing our customers.”

“One big shift is that increasingly that capacity is going to answering queries rather than training new models. “Most of what we’re building out at this point is the inference,” he said — referring to the use of computing power to run rather than train AI models.”

And of course, Wall Street for now is leaning into his argument.

“Yes, but: It’s the cost of training new models that is keeping OpenAI from turning a profit, he said. “We’re profitable on inference. If we didn’t pay for training, we’d be a very profitable company.”

“We will be always training the next thing, but if we needed to run the company profitably and stay ahead, I think we probably could do that.”

And Sam is reaching for quotations from the Arts as well:

“Altman likened the launch of GPT-5 to Dickens’ famous “It was the best of times, it was the worst of times” line.”

“You have people that are like, ‘You took away my friend. You’re horrible. I need it back,'” he said, referring to users who wanted to keep using OpenAI’s older models.

“At the same time, Altman said, the company is finding scientists saying they can finally do real research using GPT-5.”

“OpenAI has also seen traffic to its API double within 48 hours, to the point that it’s limited by compute capacity.”

“We have really got the full spread of the human experience with this one,” he said.”

He did take time to address other industry issues, especially Google and the upcoming Chrome legal decision. A topic I just addressed in my weekly podcast “AI Ramblings’.

“Here’s what else was on Altman’s mind:”

1. “If Google is forced to sell its Chrome browser as part of an antitrust settlement, Altman would like to buy that, too.”

“If Chrome is really gonna sell, we should take a look at it. I don’t have a number in mind, but I would like to have it.”

The piece goes on to describe Sam’s view on a range of industry topics by reporters, and is worth a full read.

“Fielding questions for an hour and a half, Altman weighed in on everything from his recent social media spat with Elon Musk (“There’s no grand strategy … it was probably a mistake”) to the timing of OpenAI’s next big model after GPT-5.”

But he did come back and focus on the roadmap beyond GPT-5:

“I think it’ll be faster than the previous [ones],” he said. “We’re now at a place where there’s a very strong research roadmap in front of us.”

“I don’t know an exact date,” he said, but it won’t be as long as it took to get from GPT-4 to GPT-5.”

“What’s next: Altman rejected some critics’ view that GPT-5’s more incremental advances mean that progress on improving AI models is hitting a wall.”

“But he acknowledged that limits are starting to show up when it comes to the basic chatbot functionality of ChatGPT.”

“I think the models are still getting better at a rapid rate,” he said. “One of the things that’s interesting is the models have already saturated the chat use case. They’re not gonna get much better. … The Turing test has passed.”

The discussion does summarize the ‘best of times/worst of times’ evocation. Not just for OpenAI, but the industry as a whole. And not just here, but also in that other major global market, China.

As someone who’s seen most major tech waves over the last three plus decades up close, the dynamics and drama of this AI Tech Wave thus far, surpass all others. And that is the Bigger Picture worth considering this Sunday. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)