AI: Weekly Summary. RTZ #346

-

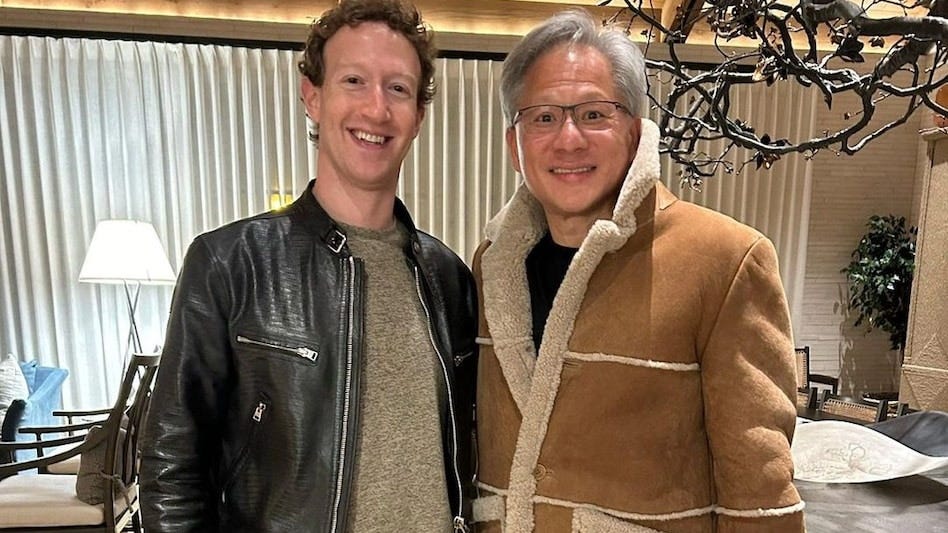

Meta’s Aggressive Blanketing with Meta AI: Company is rolling out Meta AI across over three billion users. Mark Zuckerberg talked about how his industry leading supply of 350,000+ Nvidia AI H100 GPU chips, put him in good stead vs peers. Especially in running the massive amounts of AI Inference across its massive user base. Meta also outlined a $40+ billion commitment in AI driven capex on its recent earnings call, leading peers like Microsoft, Google, Amazon and others. Mark Zuckerberg also emphasized that the company remains committed to open sourcing its Llama 3 variants. More here.

-

OpenAI’s strong Summer pipeline: OpenAI has a rich pipeline of AI announcements going into this summer, timed to keep pace with key industry Developer conferences by Google I/O (May 14), Apple WWDC (June 14), and others. Anticipated announcements include GPT-5 variants and iterations of course, along with timing on its industry leading text to video Sora LLM. Other expectations surround OpenAI’s leaked initiatives to counter Google Search, as well as its efforts with ‘Agentic Workflows’ using OpenAI assets. Those are the big ones. More possibilities here.

-

Google executes on AI Search costs: The competition and cost of AI augmented Search vs traditional Google Search has been a big public investor concern for over a year now. The company announced that they had reduced the cost of AI chatbot queries by 80% so encouraging directional progress here. The company remains focused on AI investments in the tens of billions going into the rest of this year and next. And is more focused than ever on leveraging its next generation Gemini LLM AI across Google, YouTube, and Google Cloud assets and customers. The company’s recent AI reorganization under Demis Hassabis also helps accelerate these efforts. More here.

-

The AI industry moves away from AI Fears: What a difference a year makes. Last year, OpenAI was almost overturned on its industry leading AI mission on fears of AI risks and safety. Today, as we near the end of big tech earnings reporting season, it’s clear that investors both public and private, are encouraging rising AI investments in the tens of billions, for now. It’s augmented by governments in China and worldwide, also encouraging their public and private segments on ramping AI investments, in the areas of AI infrastructure, chips, data centers, power, talent and other critical inputs like new and synthetic AI Data sources. The Fears around AI are shifting into the ‘Fear of Missing Out’. More here

-

AI Industry Alternative Data center Power Plans: This increasingly important issue is getting a lot of both investor and government attention. Meta’s Mark Zuckerberg discussed needing 1 GW (Gigawatt) AI data centers on a recent industry podcast. Amazon signed a close industry first sub-GW Datacenter in the US (Pennsylvania) with the 6th largest Nuclear power plant. Georgia Power just turned on the largest US nuclear power plant. Geothermal is another option for sustainable power data centers. Natural Gas and other sources remain other options. China is ahead of the rest of the world with almost 20 nuclear plants at sub 25 GW total in 5-10 years. All these are traditional ‘Fission’ Nuclear reactors. Next gen tech ‘Fusion’ reactors are also of interest, with Sam Altman’s early investments in Helion and Oklo being examples. Commonwealth and others also in running. Good news is increasing bipartisan support in the US government on all types of nuclear power plants for Data centers and other US national imperatives. More here.

Other AI Readings for weekend:

-

China Vidu text to video fast-follows Google Sora. More here.

-

Military slows down AI in some services. More context here.

Thanks for joining this Saturday with your beverage of choice.

Up next, the Sunday ‘The Bigger Picture’ tomorrow. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)