AI: Weekly Summary. RTZ #687

-

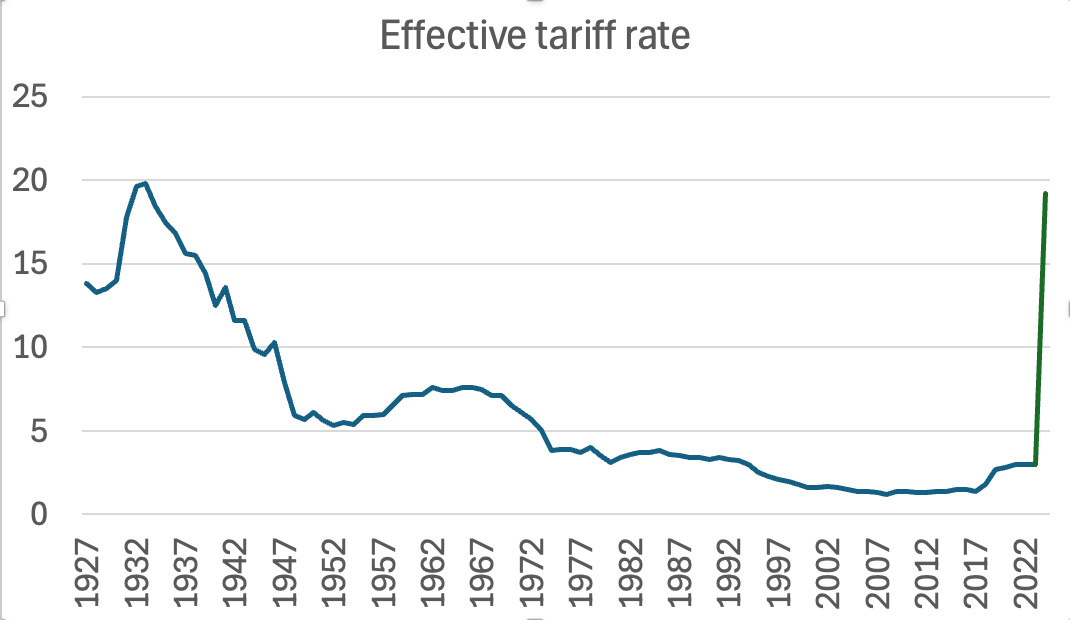

Trump Tariff Impact on US AI/Tech: The Trump Tariffs continue to shake up global economies and markets, with uncertainties despite the ‘90 day pause’ and China tariffs ratchet up to 145%+. In particular, the tariffs have singular implications for the US tech and AI companies that need to be digested by companies and market stakeholders. Besides driving up AI costs, particularly for data center construction, the tariffs also meaningfully complicate supply chains. This especially applies to ‘Physical AI’ companies in AI driven robotics, EVs, drones and beyond. The overall US lead in AI over China is potentially threatened by the tariffs, even if the current levels of tariff are negotiated down. More here.

-

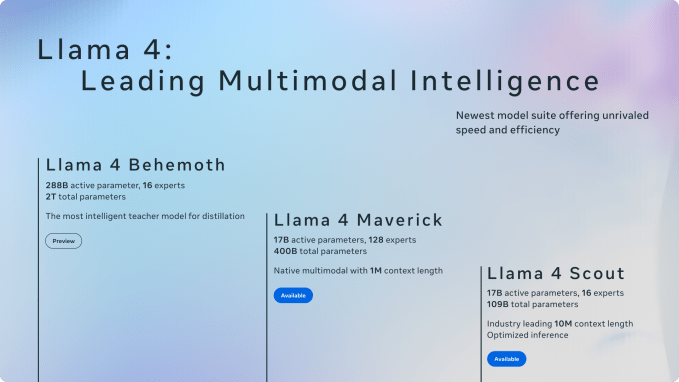

Meta launches Llama 4 on a weekend: Meta released its long awaited open source Llama 4 LLMs in various sizes over the weekend, with generally positive reception. It’s a timely response to open source challenger DeepSeek from China, both on the LLM chatbot and AI reasoning fronts. The models particularly leverage Nvidia’s upcoming next generation AI GPUs and infrastructure. There has been some controversy over Llama 4’s benchmarking processes, with reports the company having used specially tuned versions of Llama 4 for the tests. That notwithstanding the models, in their various forms, do offer the next gen LLM AI technologies, as Meta readies its 2 trillion parameter ‘Behemoth’ version for release shortly. More here.

-

OpenAI may buy Io Products, Jony Ives AI venture: OpenAI is considering buying the Jony Ive /Sam Altman AI device venture, called Io Products. Other investors include Softbank according to reports. The secretive project doesn’t offer additional details on the form the AI device may take, other than it may leverage OpenAI’s market leading LLM AI and voice technologies. This effort is one of the highlight ventures beyond the Smart Glass investments by Meta, Amazon and others, as well as AI powered Wearables by Apple and other startups like Oura in ‘Smart Rings’. AI infused hardware projects also face Trump tariff challenges as those issues get addressed over time. More here.

-

Microsoft launches AI Recall for Windows AI PCs again: After several launch difficulties and delays, Microsoft is rolling out a full release of Recall, a signature AI feature for their Windows AI PCs, that captures screenshots of user activity on a Copilot Plus AI PC. This is one of the key AI applications that promises to leverage highly personal user data and provide AI Agentic ‘recall’ features via text and voice. While the feature holds much promise, it highlights the ongoing balancing act needed as tech companies incorporate AI to leverage personal user data on their local devices, be they computers, smartphones, wearables and beyond. Apple remains singularly positioned on user trust on AI privacy, and is focused on proceeding with precautions around ‘Apple Intelligence’, leveraging its Personal Cloud capabilities. More here.

-

Apple’s AI and iPhone Tariff troubles: New reports are highlighting Apple’s ongoing organizational challenges. Particularly around issues leveraging AI across its product ecosystem. These headwinds are beyond the Trump Tariff challenges, which of course threaten its key iPhone product, accounting for over half its revenues. The company is aggressively leveraging iPhone assembly in India, and shipping iPhones into the US by airlifting iPhones by the tons. However, the core challenges remain in terms of the difficulty of shifting iPhone manufacturing to the US. And the tariffs as they currently stand, threaten to take iPhone pricing into $3500 and beyond. The AI difficulties around revamping Siri and other AI capabilities continue to be an issue for investors. All this while Google is cutting back on its hardware efforts. More here on Apple’s India efforts.

Other AI Readings for weekend:

-

Bytedance in China entering Smart Glasses. US context here and here.

-

The European Commission is considering Google, Meta, tax levies on US Tech Ad services revenues. More here.

Up next, the Sunday ‘The Bigger Picture’ tomorrow. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)