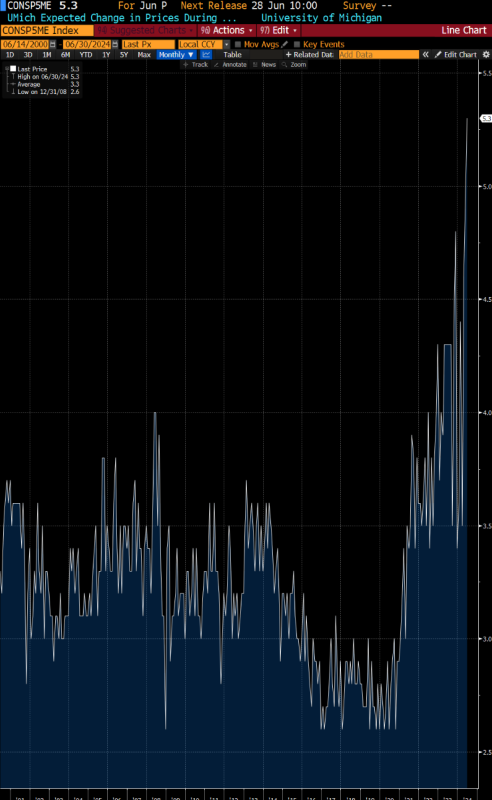

Chart of the Day – Inflation Expectations Are Not Well-Anchored

Source: Bloomberg

The University of Michigan monthly sentiment survey shows that consumers expect much higher inflation for a long period of time. The mean expectation for Inflation 5-10 years from now has hit a multi-decade high, up 5.3% yoy. This is nowhere in the ballpark of the Fed’s target of 2% inflation.

You can argue all you want about how terrible this survey is, how it’s politically biased, how it only surveys 400-600 people, whatever. Be Triggered. The data is the data.

Inflation expectations are not well-anchored in America regardless of what the Fed tells you. Folks are expecting much higher prices for a long time into the future. When inflation expectations are not well-anchored, the Fed has to work harder with monetary policy in order to bring those expectations down. That means tighter monetary policy for longer than people realize, which will be a further headwind for growth for a longer period of time. This does not bode well for risk assets. Trade accordingly.

For more real-time market color and an idea of how I am trading this, consider subscribing to my paid service where you will get access to the Private Discord Channel where I am communicating with folks throughout the trading day.