Inflation Expectations Edge Higher

From the Desk of Ian Culley @IanCulley

Goldielocks’s soft landing is proving sticky.

Commodities are outperforming stocks and bonds. Interest rates are rising worldwide, and investors are anticipating increased inflationary pressures—not multiple rate cuts—this year.

In fact, inflation expectations are reaching levels not seen since June 2022…

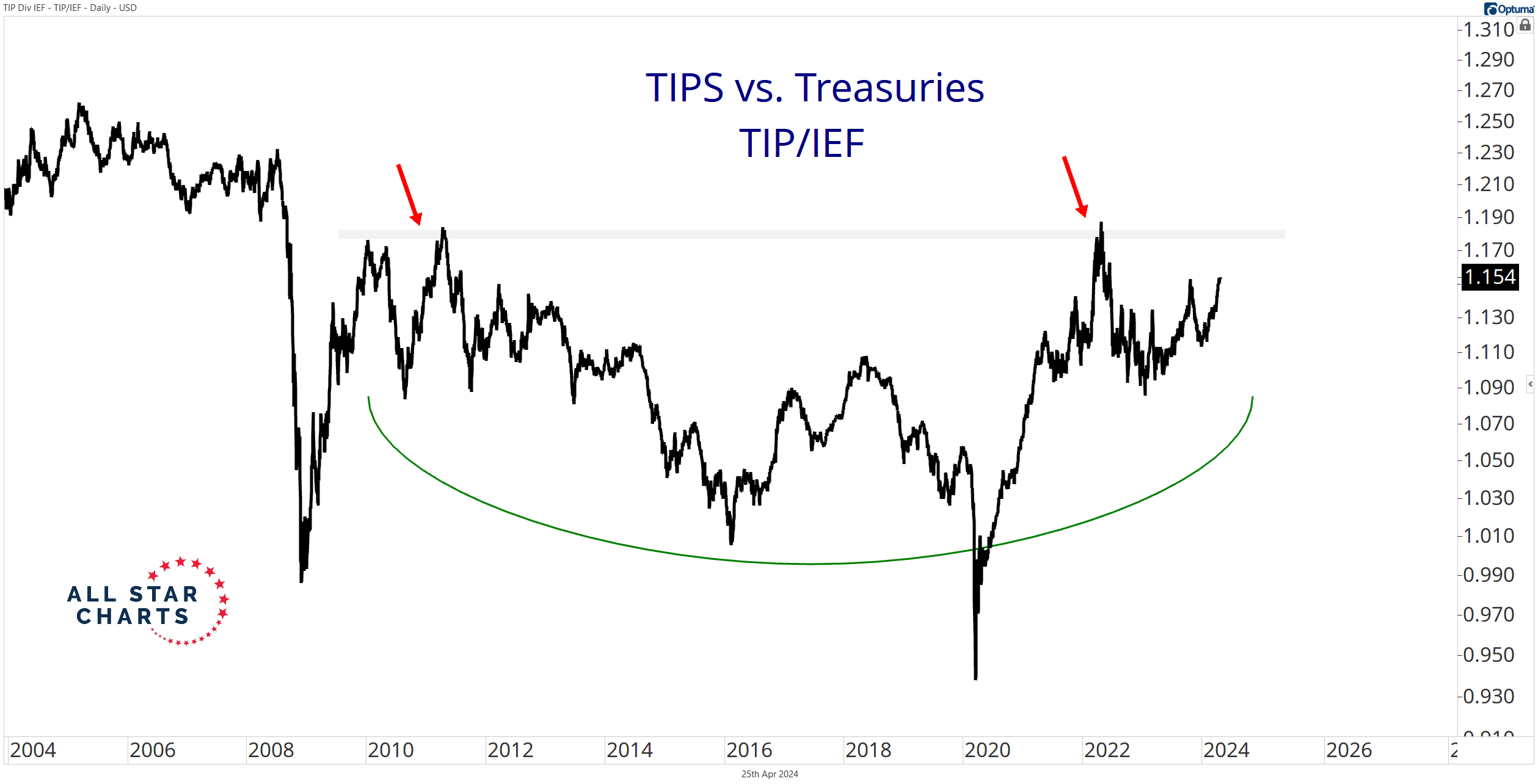

Check out the Treasury Inflation-Protected Securities ETF $TIP vs. the nominal US Treasury Bond ETF $IEF ratio zoomed out twenty years:

Monster base. But I don’t think of this ratio in those terms. Instead, I use it to gauge investors’ desire for inflation protection.

The perceived need to take action against inflation is heading back toward the upper bounds of a 15-year range, marked by the 2022 high and the end of the prior commodity supercycle in 2011.

Investors bracing for higher inflation makes sense as global yields rise and commodities climb.

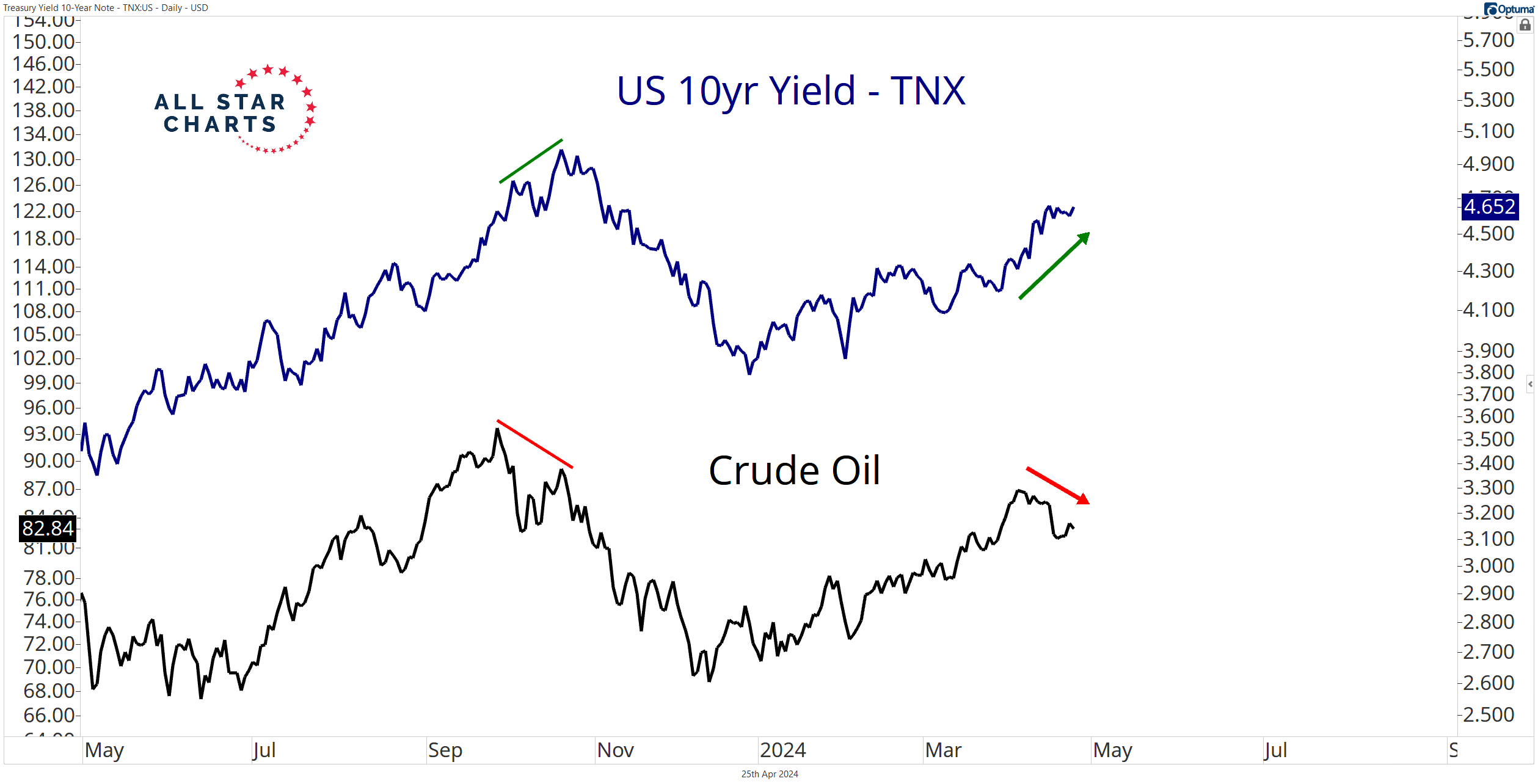

Yet over the trailing three weeks, crude oil – the procyclical heavyweight – is turning lower while interest rates surge:

Three weeks is a bit tight for intermarket relationships. Nevertheless, there is a clear divergence.

A similar decoupling occurred last fall, with crude peaking ahead of the 10-year yield by roughly three weeks. (Both fell over the following two months.)

So is it time for crude play catch-up?

Or will interest rates follow crude oil’s lead?

It could go either way. Markets are messy right now.

One thing is clear: inflation expectations remain elevated.

Crude oil and the 10-year yield will likely continue their rallies in the coming quarters.

Meanwhile, stay open to potential corrective action, and don’t let the near-term chop throw you off course.

–Ian

Countdown to FOMC

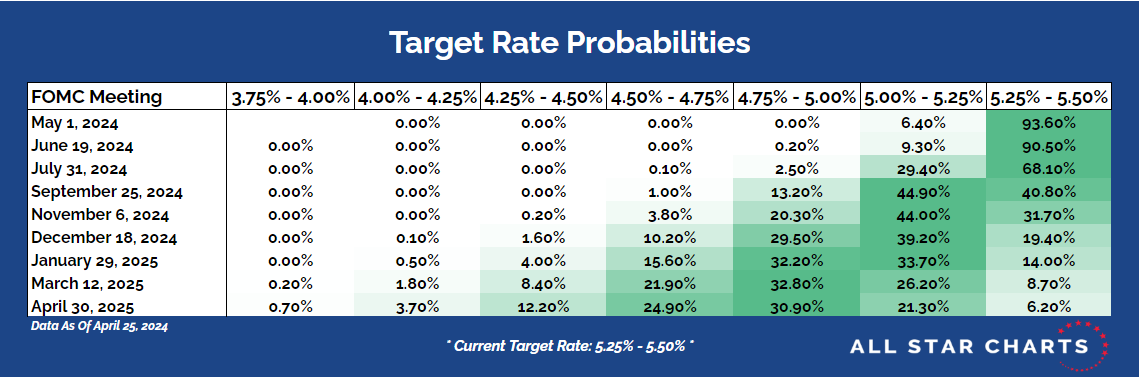

The market is kicking the probability of the first 25-basis-point rate cut further down the road to the September meeting.

Here are the target rate probabilities based on fed funds futures:

Click the table to enlarge the view.

This data is from the CME FedWatch Tool as of April 25, 2024.

Thanks for reading.

And as always, be sure to download this week’s Bond Report!

Premium Members can log in to access our Bond Report. Please log in or start your risk-free 30-day trial today.

The post Inflation Expectations Edge Higher appeared first on All Star Charts.