The Weekend Rip: Nov 30, 2025

The Weekend Rip

Happy Weekend!

The stock market spent the entire short holiday week gorging itself on gains, fueled by rate cut hopes and analysts telling everyone to buy the dip. Between Meta trying to snag a “Black Friday” deal on Google’s chips and Robinhood embracing its inner degenerate gambler, the only thing that didn’t hit a new high was the official U.S. poverty line, but economists were arguing about how high it really is. It was a week where the market’s only pause was for turkey and a data center’s busted AC unit.

Let’s recap and prep you for the week ahead. 📝

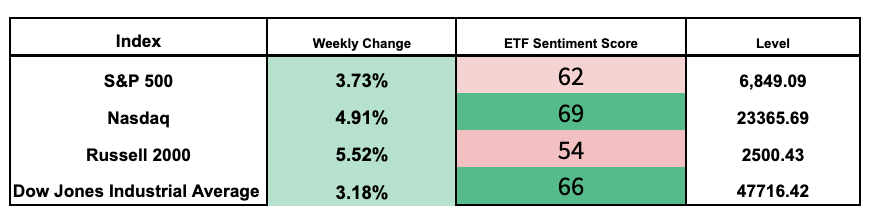

Monday 📈: The stock market kicked off the short holiday week with a big, tech-led climb as analysts told everyone to “buy the dip” and the Fed dropped major hints about an upcoming rate cut. Zoom also casually crushed earnings thanks to AI, proving those pandemic-era video calls were surprisingly profitable.

Tuesday 🛒: The market got a holiday travel boost while Google nearly hit a $4T market cap after reports that Meta is planning a massive Black Friday-style bulk buy of Google’s AI chips, much to the chagrin of Nvidia. Meanwhile, department stores like Abercrombie and Kohl’s crushed earnings, suggesting consumers are done with Zoom meetings and are now fully committed to looking good at the mall.

Wednesday 😁 : The market enjoyed its fourth straight day of gains before breaking for Thanksgiving, apparently cheered up by Fed rate cut chatter and a big bank prediction that the S&P 500 could hit 7,500. Adding to the pre-holiday excitement, Robinhood leaned into its degenerate gambler reputation by buying a derivatives exchange to offer more futures and prediction markets.

Thursday was Thanksgiving 🦃

Friday 🎯: The markets continued their holiday winning streak with a “Green Friday” half-day, capped by a bizarre 10-hour trading halt at CME due to a data center cooling issue—because nothing says “age of data centers” like a busted AC unit. Separately, economists spent the week arguing if the real poverty line is shockingly high (like, $140,000 high), which makes record-high stock prices like Walmart’s hit different.

🤩 This week’s Stocktwits Top 25 showed outperformance vs. the indexes.

SPONSORED

The Vault Just Opened on a $2T Market Opportunity

Elf Labs owns 100+ priceless trademarks for icons like Cinderella & Snow White. They’ve already earned $15M+ in royalties, and are now using AI to turn these legends into living, interactive worlds for the next generation. With patented tech & a $2T market opportunity ahead, the next chapter of entertainment is being written in real time.

This is a paid advertisement for Elf Lab’s Regulation CF offering. Please read the offering circular at https://www.elflabs.com/

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

THE BRIEF

Need a concise summary of what’s going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

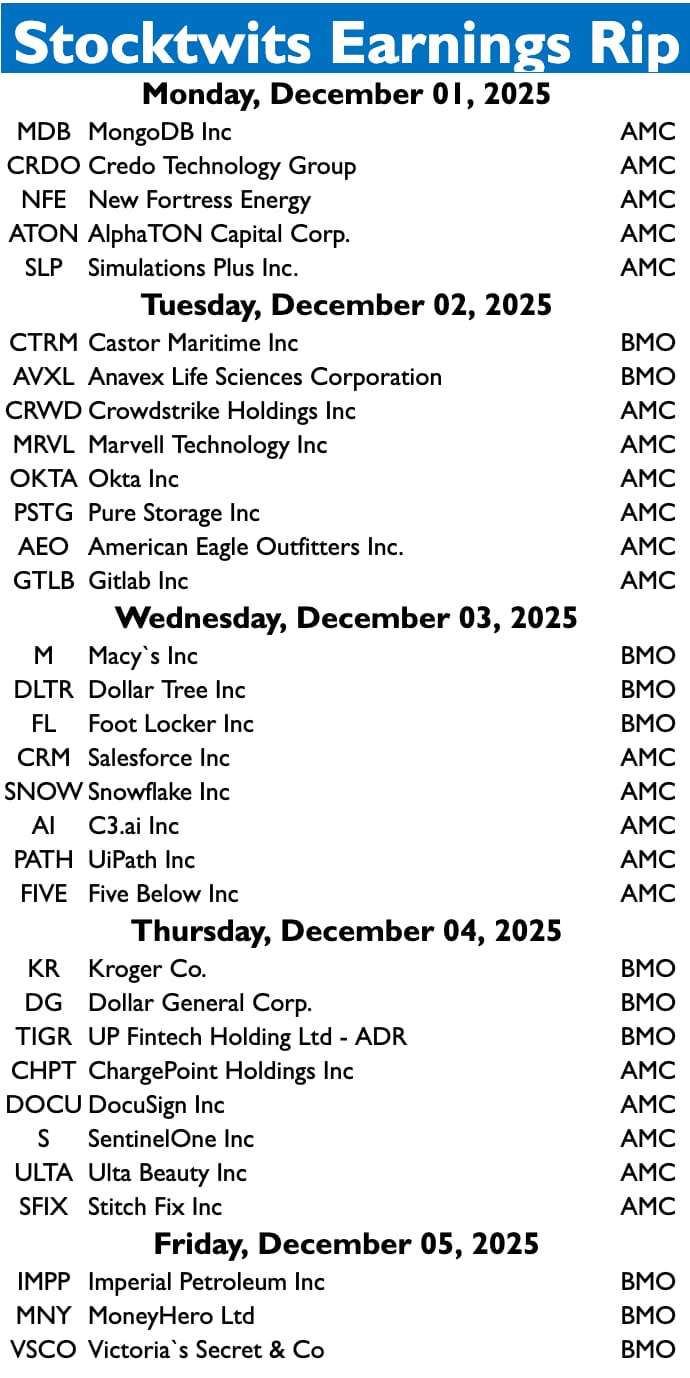

Earnings This Week

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Economic Calendar

It’s a busy week of economic data, with investors focused on September data.

In addition to the above, check out this week’s complete list of economic releases.

Links That Don’t Suck 🌐

🆘 It’s our biggest deal of the year: Join IBD Digital today for only $1/week*

🥈 Silver hit record highs in 2025 – here’s why the ‘Devil’s metal’ has further to run

🎮️ The absolute best Cyber Monday deals you can already shop

☁️ Winter storm wallops parts of Midwest on one of the biggest travel days of the year

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email Kevin Travers your feedback; follow him on Stocktwits.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋